Central banking is built on an outdated idea that could prove to be the undoing of the global economy.

Disastrous models are built on simple assumptions.

That idea in central banking is to target inflation in goods and services. The consumer price index is the holy grail of inflation watchers.

Here is the assumption, here is the part where it works in the model, heck it even worked in practice in the 20th century world. The assumption is a rising CPI is driven by domestic demand. The assumption is that workers are making more in a hot economy and buying up scare goods. Because the economy is expanding those workers will be asking for wage hikes and before you know it you have a wage-price spiral.

In a globalized world, that assumption is wrong. Inflation is coming from currency weakness, bubbles like housing and commodity shortages. Almost any non-commodity good can be produced in near-unlimited quantities at far below the cost of manufacturing. A factory in China can re-tool to produce more in a month so there’s hardly even a lag.

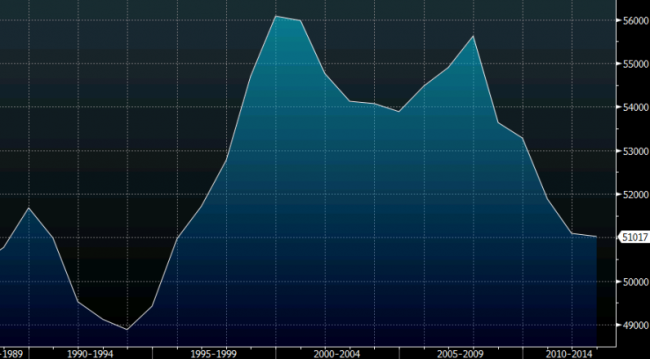

Meanwhile, inflation is non-existent in wages. Real median household income in the US is 8.3% lower than in 2007 — that’s wage deflation at more than 1% per year.

US real median household income in 2012 dollars

The borrowing function is also broken

Central banking models work great in a localized economy when central bankers could choke out domestic inflation or spur the local market with interest rates. The idea of low interest rates is that it gives companies and incentive to borrow and invest. Globalization has changed the model: borrowing is done in the US and investing in China and the developing world.

Picture yourself owning a corporate in the United States: the Fed cuts rates so now your borrowing at cheaper levels. You’re ask workers to take a pay cut because the economy suffering or you announce layoffs.

You refocus on selling globally where economies are stronger and eventually the economy picks up. Soon you have some pricing power for your product and business is good. You raise prices and that creates some domestic inflation.

In the meantime you’ve opened new markets. It’s time to invest so what do you do? Borrow money in the US and expand where there is growth and where wages are cheapest. One thing you don’t do is hire back those workers or give them a raise. No way, no how, no chance. If the Fed burns another $3 trillion to knock 80 basis points from long-term rates it doesn’t change the equation. If you need to replace skilled workers, hire a new graduate with $100K in debt and train him. He’ll work for whatever you want with those monthly payments looming.

The Fed has the power to create inflation but it can’t create wage inflation in a globalized world. At the same time, Fed-fuelled bubbles have pushed up the prices of hard assets and devalued the currency so it hits workers on both sides.

Governments should be targeting wage inflation

Japanese PM Abe

Japan has been fighting this conundrum for more than 20 years. The only way the central bank has been able to stimulate the economy with quantitative easing is by devaluing the currency. Even then, a 30% decline in the yen last year only created 1.7% growth and 0.3% inflation.

They have tried everything to create inflation and prices are still well below 2008 levels.

What’s Japan doing now? It’s targeting wage inflation. In the spring tax package Prime Minister Abe will offer tax breaks for companies that increase total wages of workers by more than 2%. The government is also trying moral and nationalistic persuasion.

For sure these are clumsy first attempts but they will be the future of inflation targeting.