- Prior 4.1%

- Sales 2.8% vs 3.9% exp. Prior 2.5%

- Consumer spending 3.3% vs 3.7% exp. Prior 2.0%

- GDP deflator 1.3% vs 1.3% exp. Prior 2.0%

- Core PCE 1.1% vs 1.1% exp. Prior 1.4%

- PCE 0.7% vs 0.7% exp. Prior 1.9%

- Exports 11.4% vs 3.9% prior

- Imports 0.9% vs 2.4% prior

Bit of a mixed report really. GDP confirms estimates but we have a dip in sales and consumer spending, inflation holds steady but a big boost in the trade numbers with exports rising to the highest since Q4 2010. Business inventories also boosted to $127bn from $116bn in Q3 and the largest since Q1 1998.

The dollar is largely unchanged at 102.60 in USD/JPY, 1.3571 from 1.3590 in EUR/USD

Running through some of the other numbers, home investment saw a decline to -9.8% from +10.3% in Q3 and the first drop since Q3 2010. Business investment in structures -1.2% vs +13.4% prior. GDP ex motors was 2.8% vs 4.7% in Q3

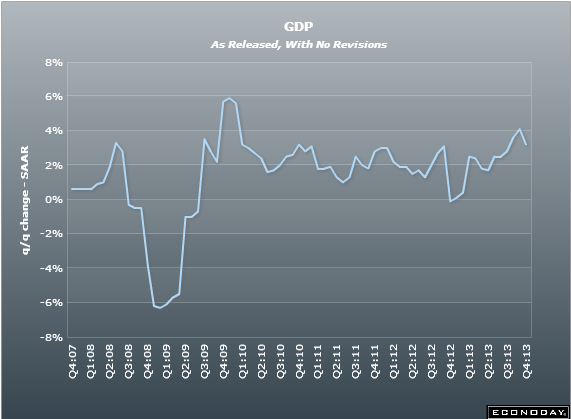

US Q4 2013 GDP flash