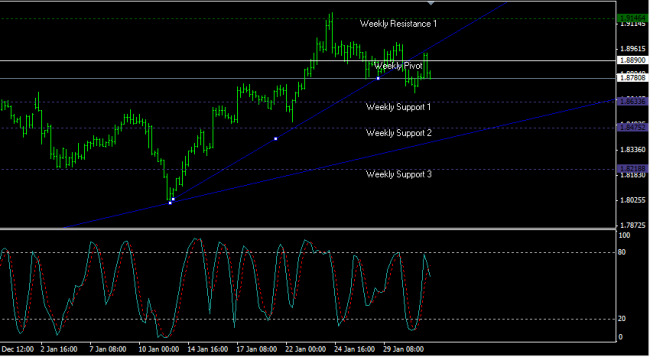

With the shorter term trend line broken and the longer one just below weekly support line 2, the GBP/AUD looks set for a run down to the 1.845-50 area. Given recent AUD strength ( call it strength or recovery) and an over bid GBP under pressure, it seems like a good play. Although the H4 100 moving average will come into play, a brief dip below is not out of the question. Especially the way the market has tended to over exaggerate moves recently.