- Prior 57.3. Revised to 57.2

- New export orders 57.5 vs 54.4 in Dec, highest since Feb 2011

- Output 59.4 vs 60.4 prior

Cable taking a trip down to 1.6370 from 1.6411.

A miss on expectations and a slight lower revision but good numbers posted for orders from abroad so it’s a bit of a mixed report. Exports increased broadly to North America, Europe Asia, Brazil, Scandinavia and the Middle East.

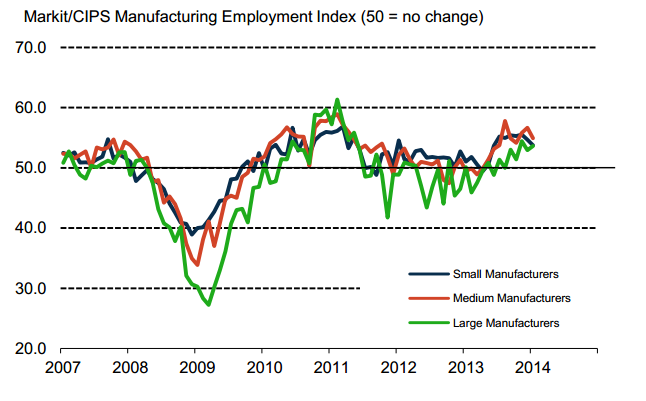

Employment was up for the ninth straight month with large manufacturers picking up the slack although small and medium firms showed a fall.

UK Manufacturing PMI employment 03 02 2014

David Noble at CIPS says;

“The continued improvement in global market conditions has ushered in a broad based and fully fledged recovery in manufacturing. Sustaining growth close to November’s near record numbers, the makers’ march continued in January 2014, embodied by ever faster rates of new business growth and ongoing increases in employment levels.

Whilst domestic demand continues to climb, it is the expansion overseas that promises continued growth. The illusive export market has long been heralded as the key to unlock UK economic growth and in manufacturing appears to be coming to fruition, with new business rates climbing fastest in nearly three years.

This has enabled firms large and small, across the sector, to invest in staff, marking the ninth

successive month on month increase in employment. The rate of growth in jobs has also remained close to November’s two and a half year high. Whilst costs climbed yet again, firms were able to pass these on to customers, a further sign of bullishness across the sector.”