I don’t think hawkish or dovish sentiment has come into it today. Only one thing was on his mind and that was to allay the fears of falling inflation. And he played a blinder. Sometimes the best way to talk out of a situation is to not to talk at all. Bar fleeting references, there was nothing on QE, halting SMP sterilisation, or any extension of talk about other plans or tools to combat the problem. He basically said “it is what it is until it’s not”.

Well played sir. Saying nothing has sent the euro shorts running for the hills as the next rate cut is as far away as it was today. How long that will keep the market at bay remains to be seen and he’s got some breathing room until the HICP final read in a week or so, but until then we need to see how squeezed the bears will get.

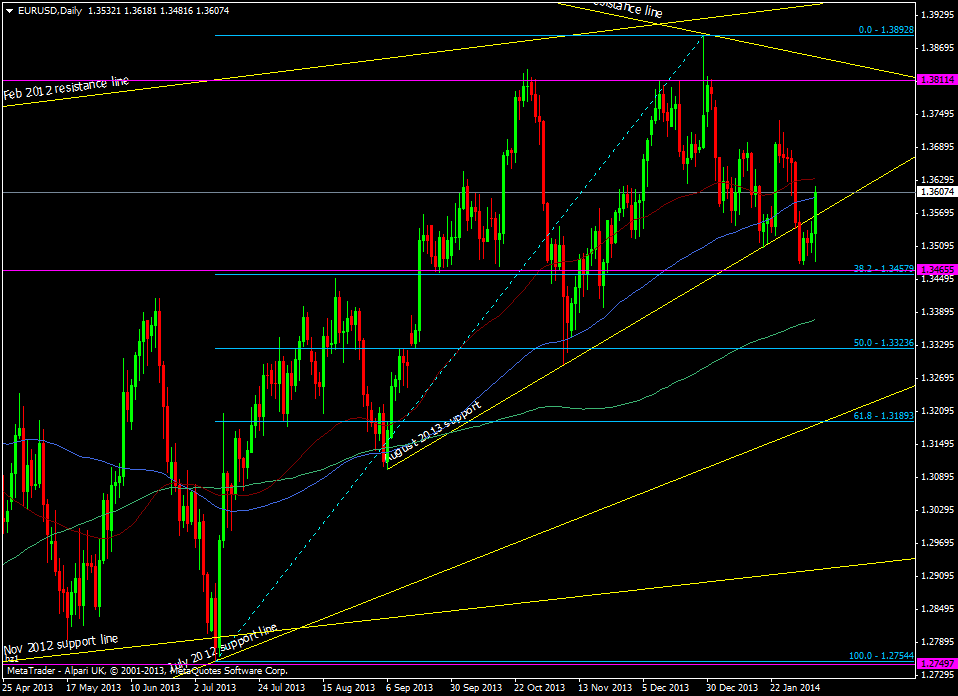

EUR/USD is trying to base itself above 1.36 after a high of 1.3619, and as Adam has pointed out, has nudged above the 100 dma. The 55 dma is next at 1.3632 and then weekly resistance at 1.3640 will be the next targets and I wouldn’t be surprised to see us having a push towards 1.37 as the market takes it all onboard.

EUR/USD daily chart 06 02 2014

Of course tomorrows NFP may decide it’s fate but knowing the euro’s ability to pull itself out of the mire even that may not be enough to turn it back down.

In the meantime look for the 100 dma to offer mild support as well as the August support line then 1.3540 if we do head back that way.