According to a note out from Commerzbank.

FX strategist Lutz Karpowitz revises year end forecast to 1.22 from 1.26 saying that the upside will be tough while the ECB stays loose and that the continued overheating of the Swiss housing market may force the SNB into raising rates and may consider abandoning the peg, though they are unlikely to this year or next.

The race to raise interest rates is the one threat to the peg that I remain focused on. The SNB moved to stem the threat of deflation and there are signs that that threat is subsiding. If the Swiss start to see inflation then that will start to get the market looking a rate rises which will put pressure on EUR/CHF. That would be twinned with possibly lower inflation in the EZ and thus the ECB looking to cut rates.

While the spectre of deflation still hangs over Europe I can see a good case for gains to be limited.

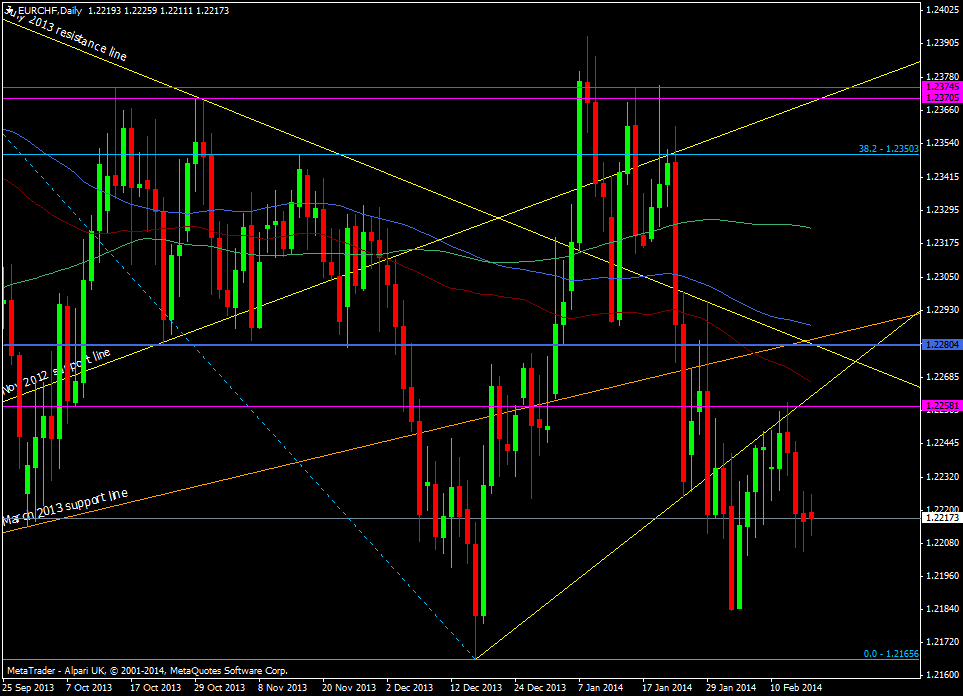

We’ve been struggling to break back above the short term support line broken at the end of Jan but there are signs that momentum is up with the pairs willingness to keep testing that line.

EUR/CHF daily chart

If we manage to take out the recent highs then no doubt we’ll be paying a visit to our old S&R friend at 1.2280. A break of 1.2166 is still needed to bring the downside into greater focus and get the SNB warming up the printers.