Everyone is reliving the crisis today and the 2008 FOMC meetings transcripts are now available on the Fed`s website:

There is so much to read but I`ll grab some nuggets, this one is from uber-hawk Thomas Hoenig at the Sept 16, 2008 meeting after he learned AIG was about to go bankrupt:

I also encourage us to look beyond the immediate crisis, which I recognize is serious. But as pointed out here, we also have an inflation issue.

Rosengren, meanwhile, knew what was happening:

This is already a historic week, and the week has just begun. The labor market is weak and getting weaker. The unemployment rate has risen 1.1 percentage points since April and is likely to rise further. I am not convinced that the unemployment rate will level off where the Greenbook is assuming currently. The failure of a major investment bank, the forced merger of another, the largest thrift and insurer teetering, and the failure of Freddie and Fannie are likely to have a significant impact September 16, 2008 30 of 108 on the real economy. Individuals and firms will become risk averse, with reluctance to consume or to invest. Even if firms were inclined to invest, credit spreads are rising, and the cost and availability of financing is becoming more difficult. Many securitization vehicles are frozen. The degree of financial distress has risen markedly. Deleveraging is likely to occur with a vengeance as firms seek to survive this period of significant upheaval.

Meanwhile, Yellen sounds out of touch. She largely agrees with the prepared forecasts and fails to grasp the gravity of the unfolding calamity, she was focused on backward looking data and cracking jokes:

With respect to policy, I would be inclined to keep the funds rate target at 2 percent today. For now, it seems to me that the additional liquidity measures that have been put in place

September 16, 2008 34 of 108 are an appropriate response to the turmoil.

Plosser`s comments also confirm that the Fed gets non-public economic data and uses it to shape its decision. The meeting on a Tuesday and he was touting a turnaround in the Philly Fed that was to be released on Thursday. He was also hopelessly out of touch with what was happening:

While a lot of attention in the short run is being paid to financial markets’ turmoil, our decision today must look beyond today’s financial markets to the real economy and its prospects in the future. In this regard, things have not changed very much, at least not yet.

On Oct 7, after things had come off the rails, Bernanke admitted he didn`t see it coming:

I should say that this comes as a surprise to me. I very much expected that we could stay at 2 percent for a long time, and then when the economy began to recover, we could begin to normalize interest rates. But clearly things have gone off in a direction that is quite worrisome.

By that point, Yellen had abandoned her earlier forecasts and was entirely supporting a coordinated 50 bps cut with other central banks:

We’re witnessing a complete breakdown in the functioning of credit markets, and it is affecting every class of borrowers. The financial developments are dangerous and are having a pronounced impact on the economic outlook. The outlook has deteriorated very sharply, and even so, I still see the risks to the downside.

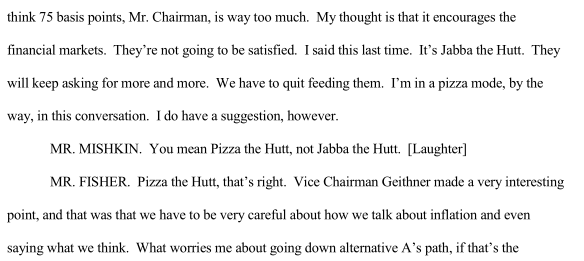

I think I just found the highlight of the transcripts for me as Fisher and Mishkin have a Star Wars, Spaceballs moment:

Classic: