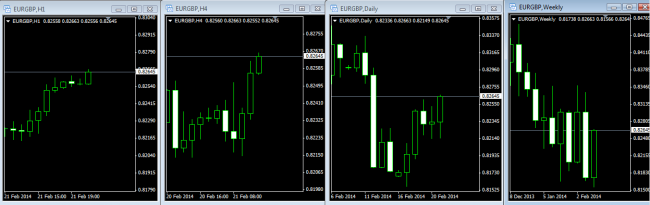

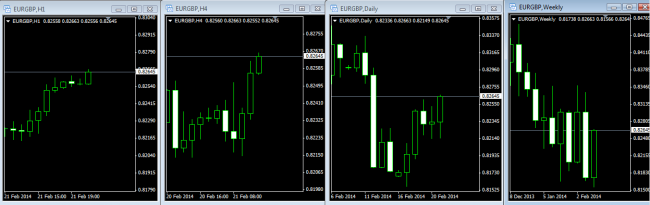

I have briefly touched before on trading Multiple Time Frames (MTF). While I generally trade H4 (four hour candles) time frames, I will often drop down to H1 (one hour) or 30M (30 minute) charts for better entries and lowers SL levels.

One of our readers commented on doing this for longer term hold trades as well last weekend, so I thought I would give an example of the way some traders do this.

- Personally, I just change the time frame on a single chart, but for some “tiling” setting the charts up by time frame side by side is the preferred method.

- Another advantage of this is that you can enter trades strictly on price action by simply waiting for agreement on all the charts.

Is it perfect? No. But nothing ever is.

It does however put the odds in your favor if all the time frames are in agreement.

EUR/GBP provided an example last week. The weekly, daily, H4, and H1 candles are all in agreement. Granted the weekly trend is still downward.