Day 3 of Steven’s run in the hot seat and he’s hitting us with some trades. You can catch up on days 1 & 2 here

Gonsalves Chalkboard Universe: Some trades are written in the stars

Now that we’ve got some trader psychology and risk-management out of the way we can move on to what you kids keep clamoring for – pictures! Today’s post has three: (1) my CAD/JPY long initiated last Thursday; (2) and (3) are closed trades from sometime in the last 3 years. All indications, aside from the prediction I made at the time, have been cut out. I want to hear what you guys see in the chart or what you would have looked for. Keepin’ it interactive! Tomorrow I’ll reveal what happened and my rationale behind the trades and, more importantly, the lessons earned from each of them.

First things first, let’s walk through my rationale behind the CAD/JPY trade.

Trade 1: A street fight between two elderly men (Long CAD/JPY)

CADJPY1

Sell the Yen; sell the Loonie: two ubiquitous trade biases for months. That makes seeing strength in either of them a trickier proposition than simply buying dips in NZD/JPY over the last few months.

Last Thursday saw Yen policy embroiled in confusion. Different BoJ members and other governmental representatives made statements about the necessity or lack thereof for further easing and the state of the Japanese economy. It was a weak currency without direction in a market that mostly shrugged off geopolitical turmoil, which is usually an excuse for Yen strength. Over that week economic data was mixed, which further cemented the lack of direction. It was heavily sold, so getting short Yen would require a special set up. Verdict: Neutral. On its own the Yen wasn’t going to move. It needs to be pushed or pulled by another currency.

The Canadian Dollar, on the other hand, had been summarily flogged lately as well. But! Last week it logged a slate of high importance data that beat estimates across the board. Then there was the abrupt departure of the Finance Minister, which, in a surprise to me, had a short-lived and uninspired effect on CAD. It was badly oversold against most other currencies, which suggests pervasive weakness but a shallower depth of downside risk. Verdict: A weak currency may have found a gentle breeze for its sails.

I decided that the Canadian Dollar was in for a bit of strength, call it consolidation if you prefer. To that I added my feeling that for now the Yen was currency without a mind of its own. So I went to the chart.

The pair failed at 90.50 in early February, late February, and again last week. I saw that the level had historical significance when it served as resistance for a while at the beginning of 2013. The RSI and the pair showed signs of a double-bottom and the Canadian dollar ETF and RSI showed the beginning of a move upward.

My Call: Get long with the benefit of a tight stop just below a major point of resistance. The limit and stop were decided in conjunction with yesterday’s post.

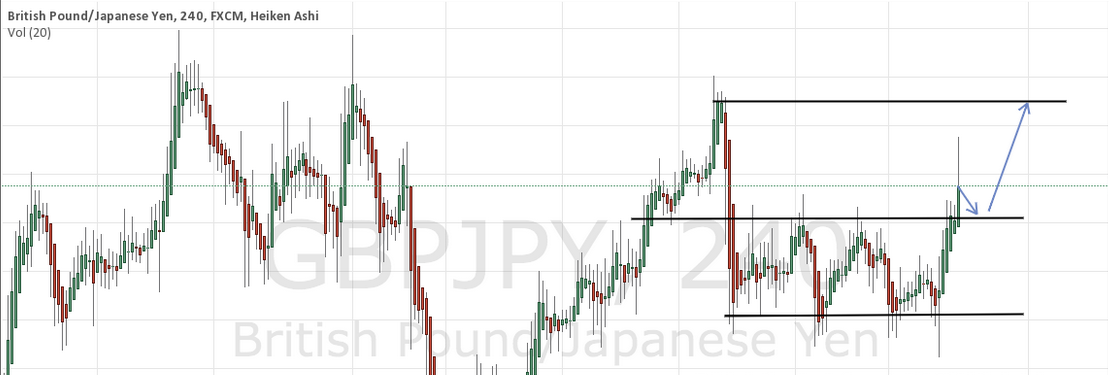

Trade 2: Shortsighted or Psychic? (Long GBP/JPY)

GBPJPY1

To state what the little arrows are saying. I saw what I thought was a strong close to break a bout of pretty solid ranging. Having ripped off Mr. Adam Button’s phrase, I was waiting on the buyer’s remorse to get long. The middle line was my entry point. The bottom line represented the bottom of the range, not my stop. Without giving numbers away yet, the stop was about halfway down the range.

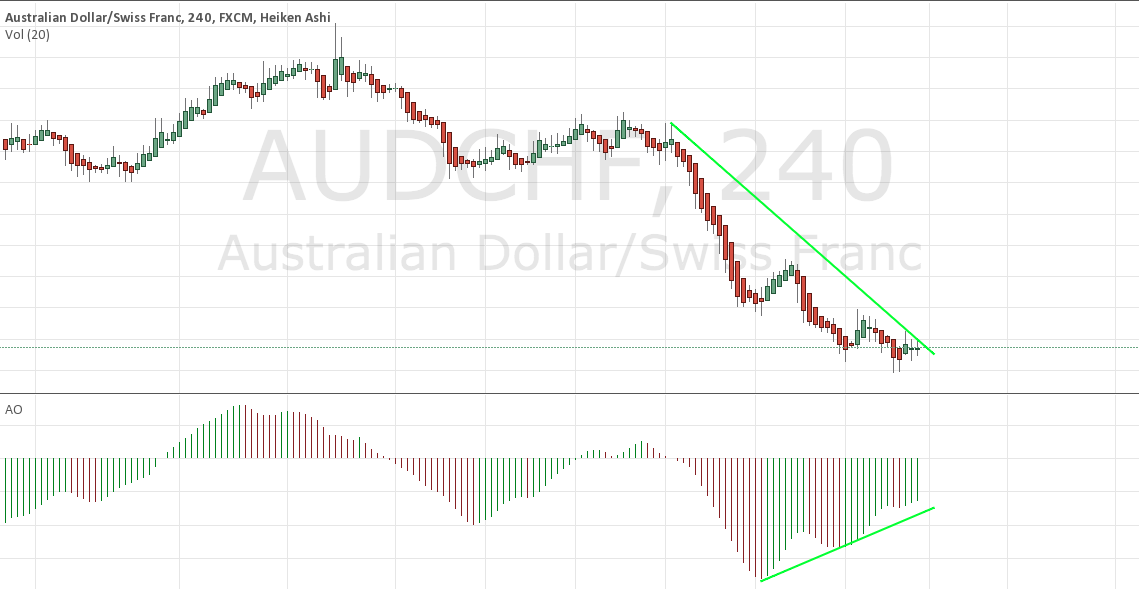

Trade 3: The Party Can’t Go On Forever. Right? (Long AUD/CHF)

AUDCHF1

I ended up waiting about 2 more candles before jumping in here with a stop below the lowest point you see on the chart.

So, on the GBP/JPY and AUD/CHF charts above, tell me what you see and which way you would have traded and we’ll compare notes when I reveal the outcomes tomorrow.

That’s all for today. Tomorrow’s post will feature the resolution of trades 2 and 3, and, I have a feeling trade 1 as well. I’ll also share my research spreadsheet that I compile every Sunday to set the tone for the week. I am firmly on the “data journalism/science” bandwagon. Today’s post depends on your participation and I’ll be around all day, so let’s hear it!

Happy pipping.