Credit Agricole took a long in cable at 1.6640 back on the 27th March with a target of 1.7050 and stop at 1.6350 and today they reaffirm their bullishness. They cite yesterdays industrial production data and rising expectations of a BOE rate hike as reasons why the pound will perform well.

I’ve been following their fortunes recently and here’s their current score card

- Short EUR/USD 1.3780 TP 1.3300 SL 1.4160

- Long AUD/USD 0.8780 TP 0.9530 SL 0.8925

- Long USD/JPY 102.39 TP 109.80 SL 98.65

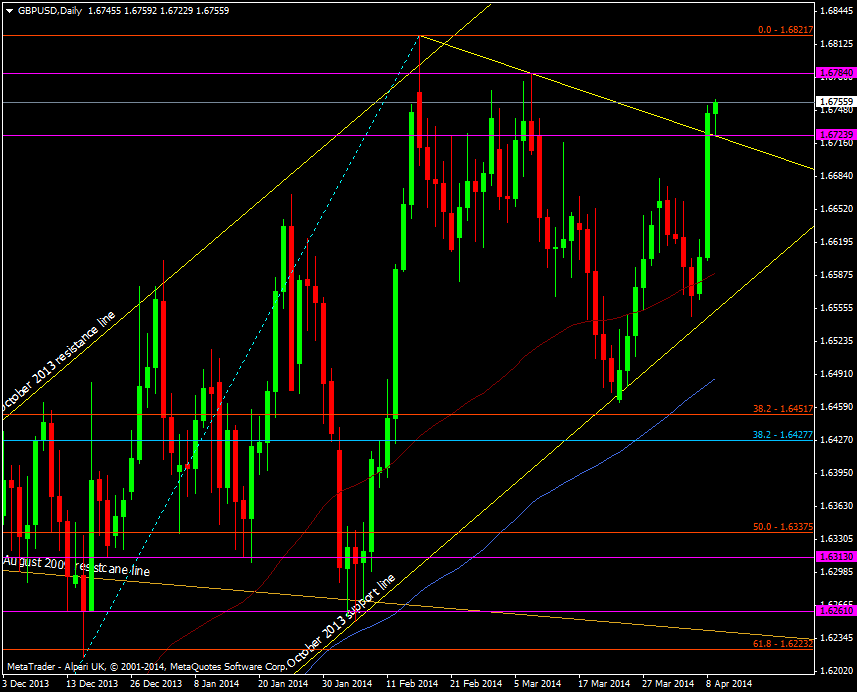

The pound broke through short term resistance from Feb and has used that and prior resistance at 1.6724 as support today.

GBP/USD daily chart 09 04 2014

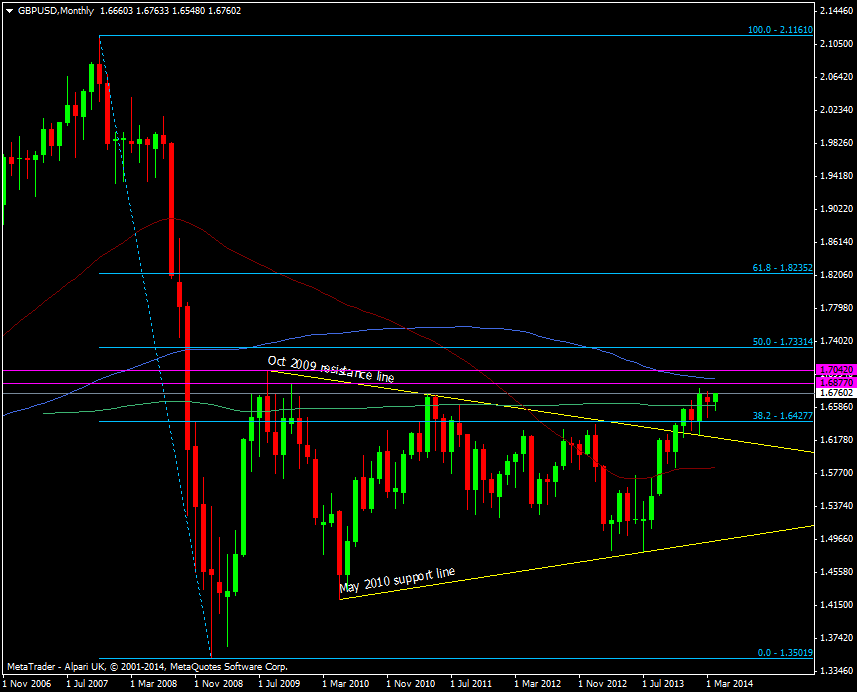

1.6784 is next on the shopping list before we try our hand at the year high so far at 1.6822. We’re also managing to stay above the 200 mma at 1.6615 which maintains the bullish momentum. Above here we have the Nov & Aug 2009 levels to look for at 1.6877 and 1.7042 with the 100 mma sandwiched in between at 1.6939.

GBP/USD monthly chart 09 04 2014