The minutes of the March 18-19 Federal Reserve meeting will be released at 2 pm ET (1900 GMT).

The meeting was notable for two events:

1) The statement switched to qualitative guidance from clear forward guidance.

In practice:

The current exceptionally low target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent.

Was changed to:

The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends.

2) In the press conference, Yellen was asked about what is a `considerable period` and went on to say:

This is the kind of term it’s hard to define, but, you know, it probably means something on the order of around six months or that type of thing. But, you know, it depends. What the statement is saying is it depends what conditions are like. We need to see where the labor market is. How close are we to our full employment goal? That will be a complicated assessment, not just based on a single statistic. And how rapidly are we moving toward it? Are we really close and moving fast? Or are we getting closer, but moving very slowly?

The thing is, the minutes aren’t likely to dwell too much on either of those points. If the members did talk about a timeline and there was a consensus around 6 months, that would be hawkish and the US dollar would jump.

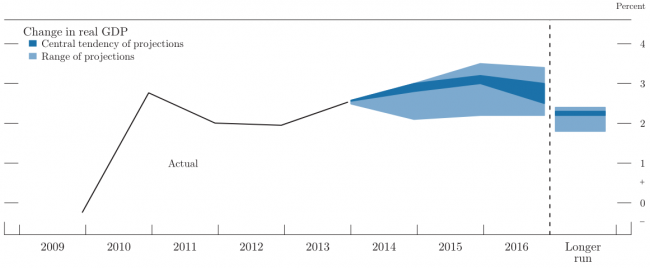

If not, the weather and forecast improvement in the economy is likely to be the highlight. The Fed has been clear — almost unanimous — that the economy will pickup this after the weather clears. That said, negative headlines could take the spotlight because the central tendency of forecasts for 2014 GDP moved to 2.8%-3.0% from 2.8%-3.2%.

Fed GDP forecasts

The final notable point will be inflation comments. The Fed is comfortable that inflation will pickup but there are some questions about wage growth and the participation rate. This one could go either way but unless there’s a strong statement on the risk of high or low inflation, don’t expect a market reaction.