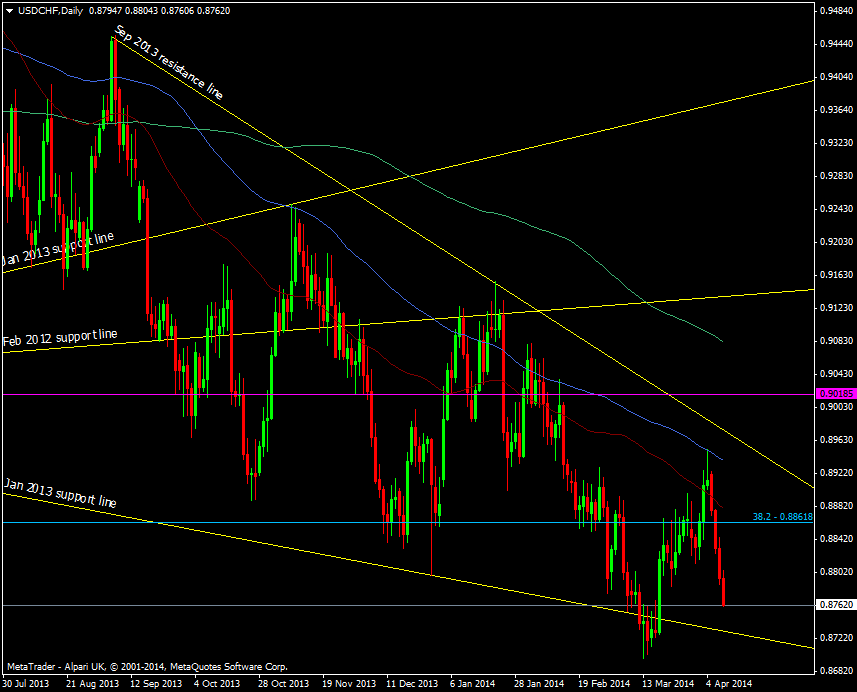

As the dollar takes another beating USD/CHF heads down towards the Jan 2013 support line currently at 0.8729. Since touching the highs at 0.8950 four days ago it’s been a one way street south.

USD/CHF daily chart 10 04 2014

A break through the support line will target the March lows at 0.8696/8700 and below there there’s not much until the 50 fib of the 2011 swing up at 0.8519 with the Oct/ Nov 2011 lows around 0.8600 and 0.8564 just ahead.

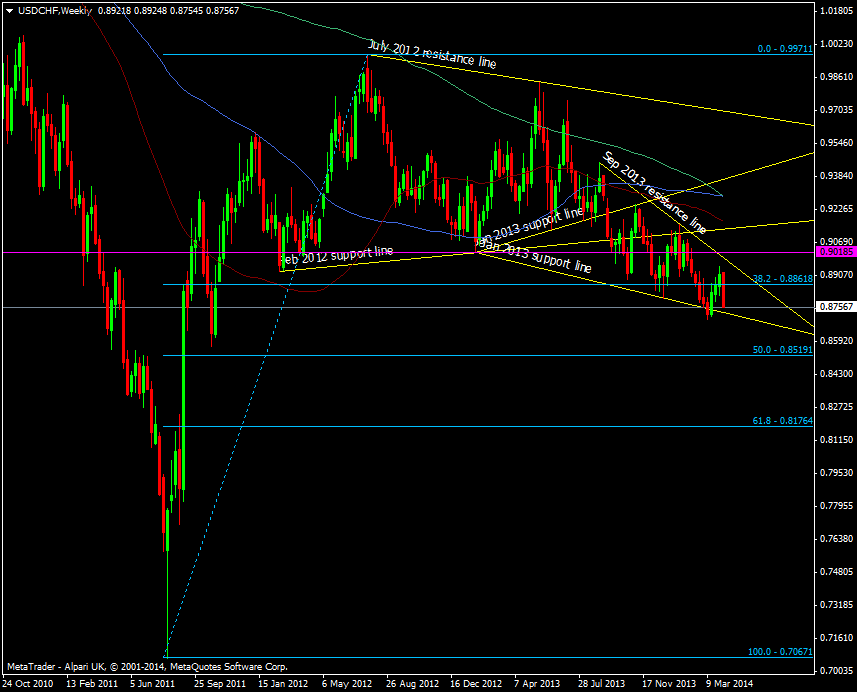

USD/CHF weekly chart 10 04 2014

USD/CHF longs was one of my plays for a bit of dollar strength but they’ve been rubbish since I put them on in Feb. Not by design, but with my EUR/USD longs, it’s given my a really crappy EUR/CHF average somewhere in 1.24. I was looking for a bit more upside to get shot of them as my first entry was at 0.8994 down to 0.88 and I think I’m going to rue not cashing them in the other day.

It gives me two choices though as the pair is the anti EUR/USD. I can either take a loss if it craps out through the levels or keep hold with my EUR/USD longs thus at least giving me time, if anything, to work my way out of it. One of the lessons taught on the LIFFE floor was never to spread out of a bad position, i.e trade the opposite way in another contract month. I never listened as I believed it gave me a better chance to work my way out, and many a time I did. That was futures and the same contract and this is FX and different currencies so I’m not sure that same strat is going to be applicable. I might give it a go though but it’s not something I’d advise others to try.