WTI crude is still riding high despite the fact that there is a build up in supplies in Houston and along the Gulf coast and not much of it can be shipped out. Details within the EIA supply report yesterday showed the region had stocks totaling 202m barrels, the most on record.

Due to US export restrictions there are only 13 ships than can legally move the oil and they have been fully booked out.

The higher price recently is a mix of Ukraine worries and gasoline drawdowns but it could also be having an effect from the lack of ships available to meet demand. It’s no good swimming in oil if you can’t get it out quick enough.

Oil traders say the effects are likely to filter down into prices later this year and see the WTI discount to Brent increasing to $13 from the current $4 and EIA 2014 forecast of $9

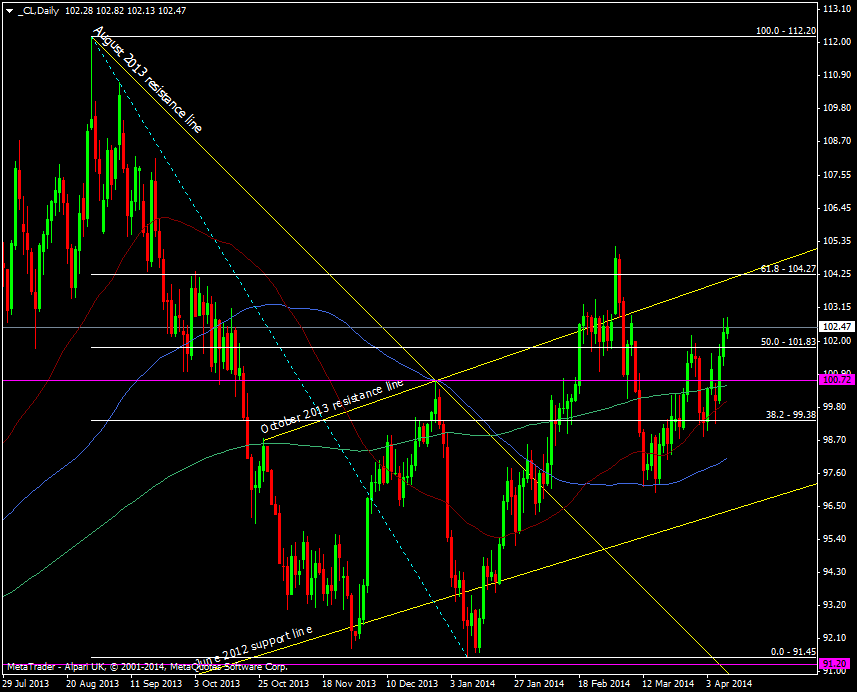

In the June contract WTI is struggling to break above 103 with 102.80/85 capping the moves over the last two days

WTI crude daily chart 10 04 2014