Both S&P and Moody’s will be publishing their latest sovereign rating reports for the UK after close of business later, and if we get any positive vibes then we might get a late crack at the big figure.

Moody’s perhaps holds the biggest playing card as they could give us back the triple A status they took away back in Feb 2013.

I was covering Adam that day and the move came right out of the blue, right at the death and crunched the pound.

When poo hit fan 22 Feb 2013

This could be one reason we’re not seeing a bigger move away from 1.70, even though we have been down nearly 50 pips from the high.

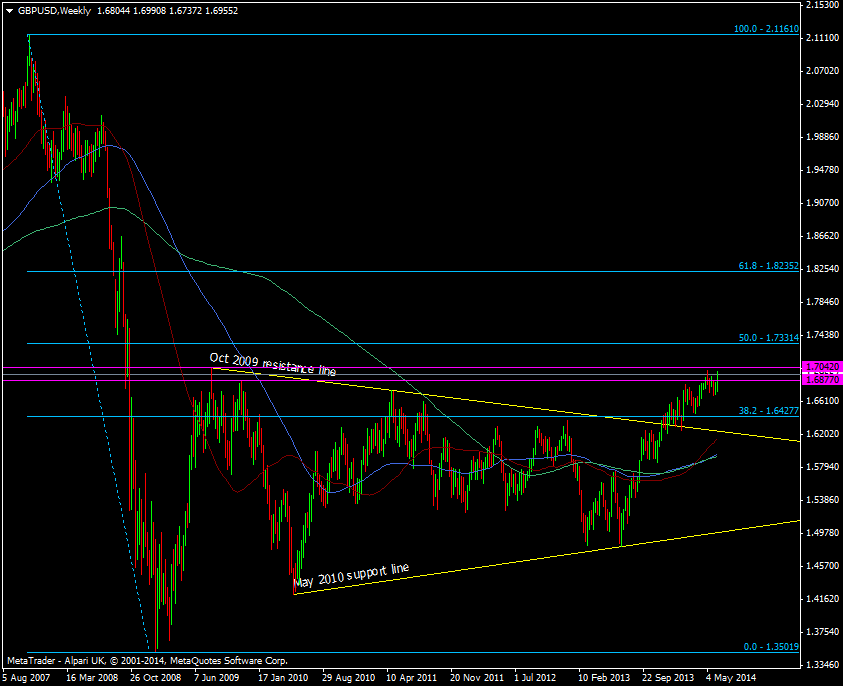

The DNT is still said to be in place at 1.70 and then we have the 1.7042 level marking the Oct 2009 high which is in a lot of big banks playbooks as a level to watch.

GBP/USD weekly chart 13 06 2014

The longs will need to maintain their grip up here or it will be a swift trip down to 1.69 or less. I was orders in earlier to short at 1.6995, which missed by a couple of pips, and now I know about the ratings risk I’m pulling the order.

Support is likely to be mild at 1.6940, 1.6920 with maybe a little more strength at 1.6900. Yesterday’s pre-Carney levels around 1.6840/60 will likely be the destination should we drop through 1.69.

Also adding some euro risk is ratings reports for Italy (Moody’s Baa2), France (Fitch AA+) and Austria (Moody’s Aaa).

Something to be aware off when the school bell goes later

Update: I’ve just heard there was some chatter in the market that the UK will be marked up to neutral from negative so something may already be priced in