From the Société Générale Cross Asset Research team’s ‘Forex Weekly‘.

Major FX themes:

- The dovish Fed, coupled with growth supportive monetary policies globally, will continue to restrain volatility across global markets through the summer

- Sterling will do well, as the BoE shifts away from the low rates-for-longer message, but plenty of good news is already in the price, so the pace of appreciation should moderate and differentiate

- The UK’s large current account deficit is not an imminent threat to GBP strength, though a long -term concern

- Sell EUR/GBP on rallies

More on GBP:

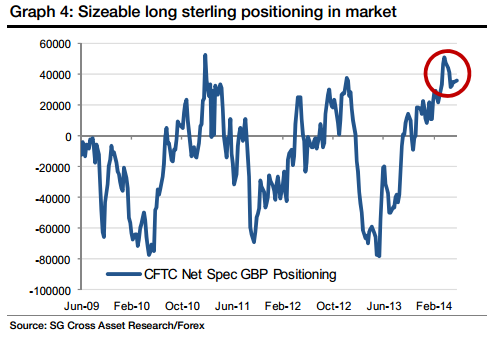

- Correlation trade: The fading sterling factor. With the BoE early exit theme now well priced in, the GBP factor is set to fade, allowing downside in both EUR/GBP and GBP/USD. Cable is threatened by heavy long positioning and EUR/GBP is skewed to the downside as the ECB is pressured to deliver more easing. The correlation between EUR/GBP and GBP/USD has been strongly negative until now: expect it to retreat.

- Says there is ‘sizeable long sterling positioning’ in the market:

On EUR/GBP:

- Breached below a multi-year trend line support

- Is poised to test 0.7754/0.77

- Short-term pullbacks should be capped at 0.8069/85

On the Dollar Index:

- bounced after bottoming out in May at 79/78.60

- should find support at 79.70/79.40