- Prior -1.0%

- GDP sales -1.3% vs 0.0% exp. Prior 0.6%

- Consumer spending 1.0% vs 2.4% exp. Prior 3.1%

- GDP price index 1.3% vs 1.3% exp. Prior 1.35

- Core PCE prices 1.2% vs 1.2% exp. Prior 1.2%

- PCE prices 1.4% vs 1.4% exp. Prior 1.4%

- Q1 corporate profits -13.0% vs -13.7% prior

- Exports -8.9% vs -6.9% prior

- Imports +1.8% vs +0.7% prior

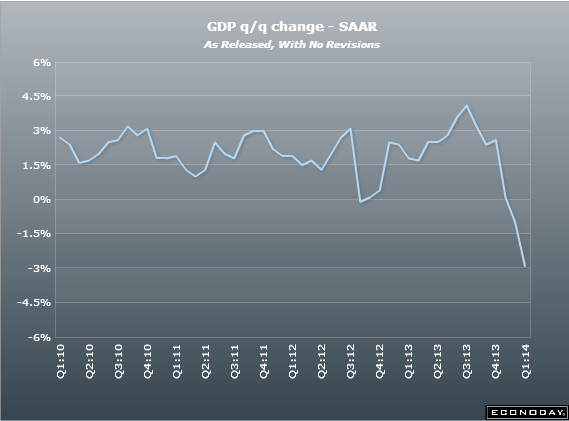

That’s a stinker. USD/JPY smacks down only 18 pips on the crappy revisions

The consumer spending number is the lowest since Q4 2009. Durables suffered (+1.2% vs +1.4% prior)

Business spending saw a modest jump but still negative (-1.2% vs -1.6% prior). Business investment in structures fell further (-7.7% vs -7.5% prior). Inventories fell $3.1bn and lopped 1.70 percentage points of the GDP change

Home investment slowed by only 4.2% from a 5.0% fall prior

Exports cratered in the final read and that leaves some large question marks over growth going forward. As we advised these are revisions so no matter how much they look bad, and they do, They are likely to be brushed off by the weather. If Q2 doesn’t show a good rebound then the dollar could be in for a whole heap of trouble.