In an article for the Global public investor 2014 he sings the same old song that the Swiss franc continues to be seen as a safe haven currency and maintaining the minimum exchange rate remains the right measure.

He adds that the SNB isn’t intending to sell any gold and around 90% of FX reserves are managed at SNB HQ with around 10% in Singapore and 1% elsewhere.

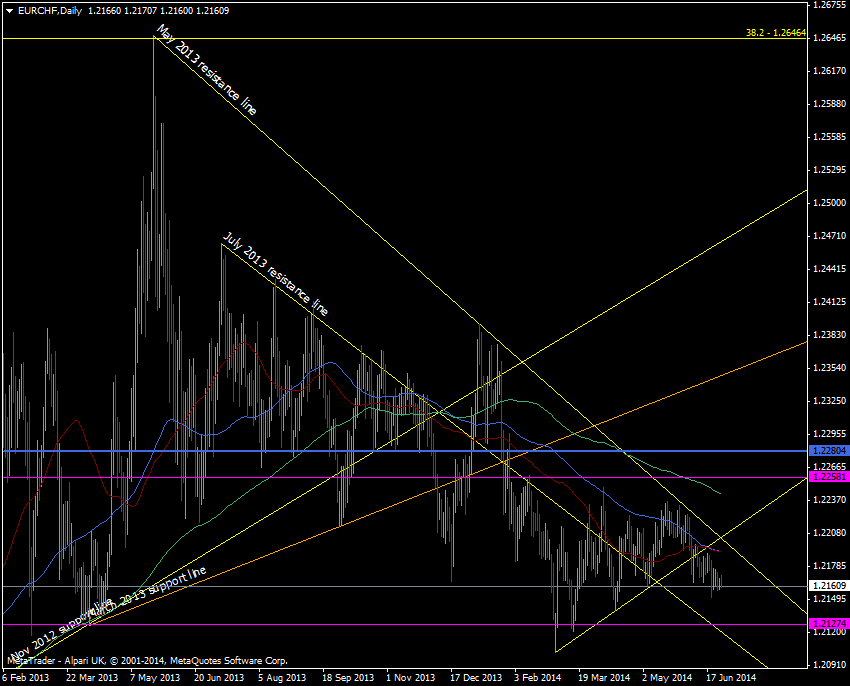

At the moment we haven’t seen any big adverse effects from the ECB action in EUR/CHF but it’s starting to drift down through 1.21 again. A break of 1.21 will have the cuckoo clocks sounding an alarm in fondue land.

EUR/CHF daily chart 26 06 2014