If you look far out on the investing horizon a fear is building that Yellen could get behind the curve on inflation. It might even be intentional.

Yesterday, Kocherlakota was saying the Fed should tolerate some inflation so long as longer-term forecasts and expectations don’t move up. Yellen has also hinted that she might be willing to let inflation run a bit above target to allow wages to catch up before taking away the punch bowl.

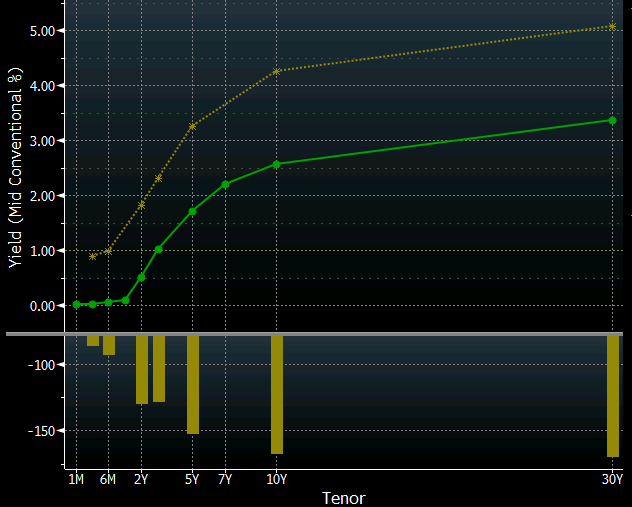

It’s not necessarily just the first hike but also the pace of subsequent hikes and the high in the Fed funds rate. If the market gets the sense that the Fed is willing to tolerate above-target inflation it would mean lower front-end rates for longer but a higher chance of inflation — essentially steepening the yield curve.

That might be by design because higher long-term borrowing rates could offer an incentive for companies to invest and banks to lend. They might aim to move the curve up to where it was a decade ago.

Current yield curve (green) 2004 curve (brown)

Any higher rates would be bullish for the US dollar but the extent of how the market reacts depends on sentiment around how far the Fed is behind the curve. If the market begins to sense an inflation problem and sees the Fed unwilling to hike in the near term, that could translate into more hikes down the road but that’s also something that could choke out the economy. We’re a long ways away from that point but if the Fed continues to brush off good news, it’s a risk.

In short, there are no easy answers but I would focus on 10s and 30s rather than the front end. Ultimately, if the economy is picking up it will be good news for the dollar but it will be an often-painful trade if the Fed is reluctant to hike.