The CPI numbers will grab the headlines and rightly so. That was a worryingly big jump in inflation across the board.

We saw the May retail sales held up by football fever as the UK bought up football shirts and that’s translated into the prices with clothing one of the big risers. The ONS said that retail clothing and footwear (3.2% vs -0.1% prior y/y) didn’t suffer their usual summer falls and that retailers held off discounting. Retailers must have been gutted that England lasted only two games and while it may show that June retail sales got a boost, July may disappoint.

Furniture and household equipment also saw a sizable jump 1.6% vs 0.9 prior) and that will also be because of a rush to ship in new tv’s and furniture for the World cup. Again this will reflect in retail sales in June but will probably wash out in July.

On the flip side, year on year producer input prices fell again in June (-4.4% from revised -3.8% y/y), even after a smart upward revision in April’s numbers. That partly reflects the current strength of the currency as a fair chunk of the input price are imported.

That’s one aspect I’ve talked about a lot as we import more than we export, therefore the balance for the strong currency means those imports become cheaper. It somewhat negates the higher exports costs as we then have the scope to reduce selling prices in line with input costs being lower.

We can see that somewhat in effect with the lower output prices (0.2% vs 0.5% prior y/y). In the simplest of forms look at it as a profit margin calculation.

So, on the face of it the PPI isn’t an issue. It will be if input costs rise forcing output costs up, and if the pound retains (or increases in) its strength. At the moment it’s still a positive for the economy.

The inflation numbers will be the bigger concern and that core number rising will maybe have the BOE getting a little twitchy. Certainly it puts rate rise expectations right back at the forefront, not that it had moved far off anyway.

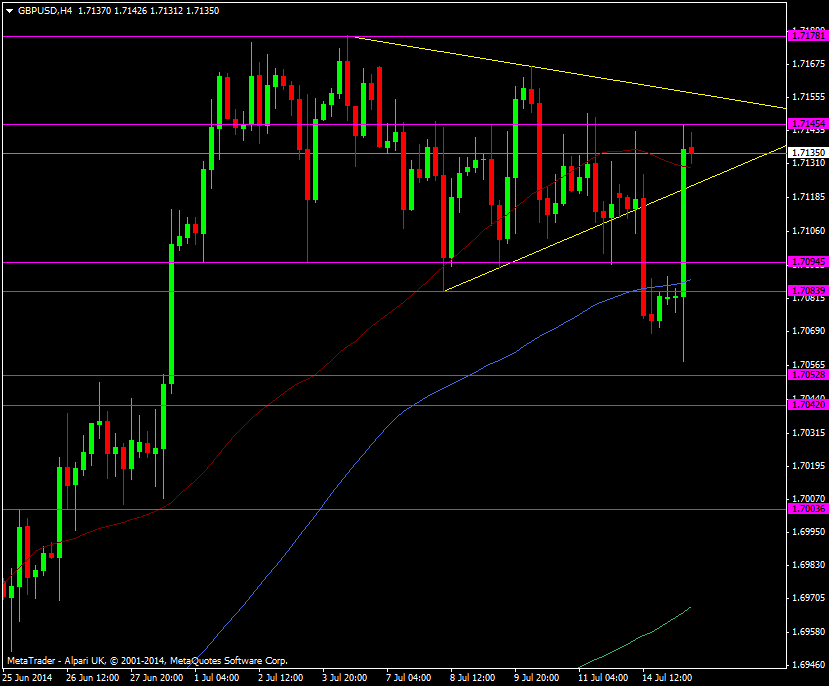

As we can see from the price of GBP/USD it’s not wanting to give up the highs right now and the hawks will be invigorated by those numbers.

The resistance is looking strong up here at 1.7145/50 and I feel that if it does go then we could be in for some fun.

GBP/USD h4 chart 15 07 2014

As is often the case look for the 1.71 level to hold some support if we move back down. I suspect those numbers will keep the bid in the pound and the hawks happy for quite sometime.

Hawks 1 v Doves 0