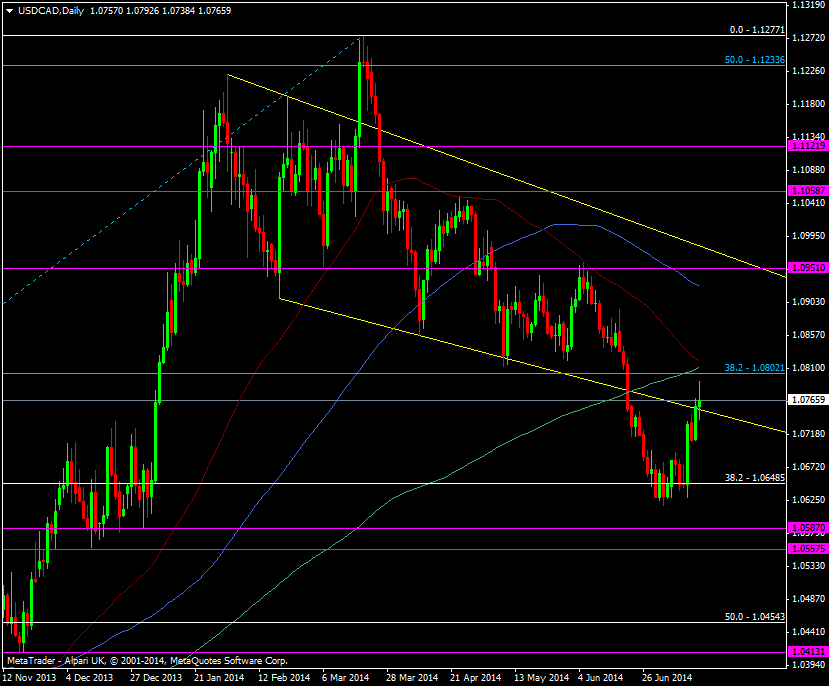

USD/CAD popped to 1.0794 on the Bank of Canada’s interest rate announcement and back above the broken Feb 2014 support line. Bar a little wobble over the release it’s using the trendline as support once more.

USD/CAD daily chart 16 07 2014

The BOC are sticking to the line that inflation is temporary yet as we’ve seen, inflation has been rising all year. It’s a dangerous game the BOC is playing and one that the Bank of England played. The BOE said the same thing as they watched inflation run above target for nearly 5 years.

The market is still buying into the BOC spiel but it won’t forever, particularly if it keeps on rising.

In the meantime the favourable trade is from the short side and the coming together of the 200 and 55 dma’s is looking a suitable technical level to start from. 1.0800 will hold resistance and the moving averages are at 1.0810/20 so it might be worth dropping a line in just ahead of all of that.

I think they are onto a loser with the constant talk of “temporary factors” and will trade against them. I will want to see a sustained drop in inflation before I call quits on it.