Overnight news ( (Bloomberg: Missile Hit Malaysian Jet in Ukraine and Israel launches a ground invasion in Gaza) has had, and is having continuing, impact on markets. I thought I’d take a look at some of the technical analysis from CS. The people at Credit Suisse technical analysis produce their reports every day, and today was no different … except they did so before the tragic news started to hit. If you view technical analysis as being helpful in getting you on the right side of a trend, aspects of their report on Thursday morning (Europe time) are very encouraging, and hats off to the people there.

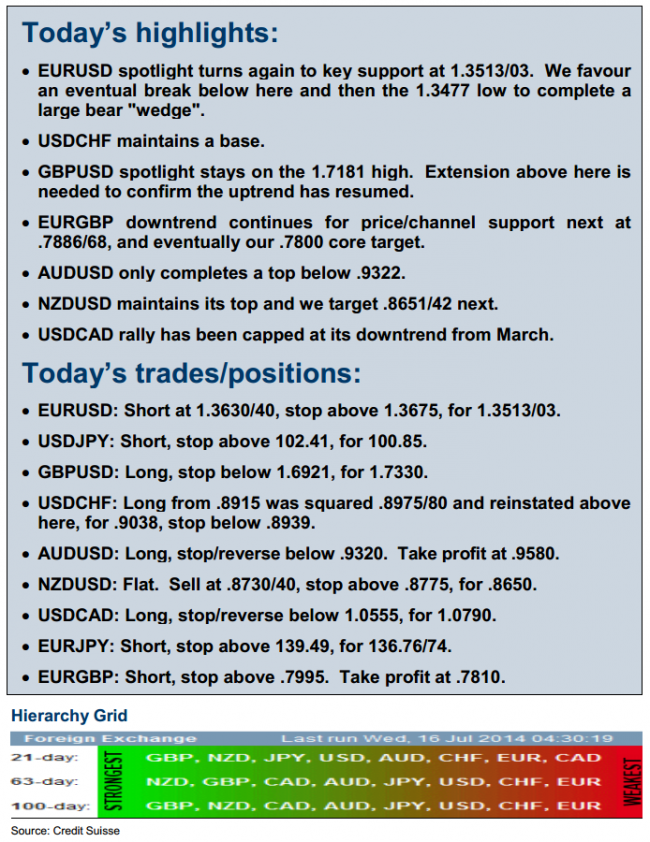

In brief, (and I won’t be cherry picking):

–

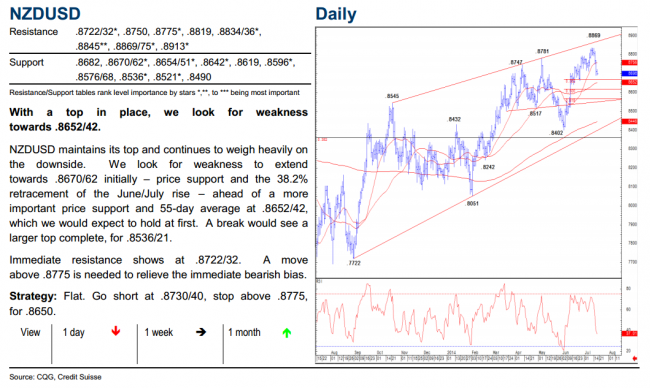

I’ll just highlight their NZD view:

Some good comments in there:

- With a top in place, we look for weakness towards .8652/42.

- NZDUSD maintains its top and continues to weigh heavily on the downside.

- We look for weakness to extend towards .8670/62 initially

–

Like I said, if you view technical analysis as an aid to get you on the right side of a trend, the people at CS have done pretty well.

What do you think?