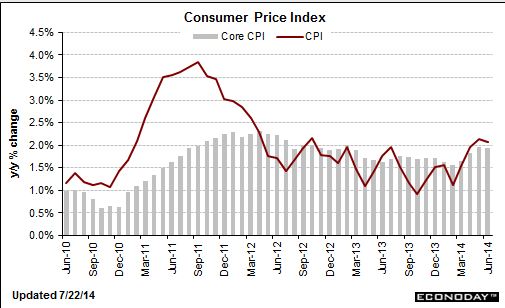

- June 2014 US CPI 2.1% vs 2.1% exp y/y

- Prior 2.1%

- 0.3% vs 0.3% exp m/m. Prior 0.4%

- Core 1.9% vs 2.0% exp y/y. Prior 2.0%

- 0.1% vs 0.2% exp m/m. Prior 0.3%

- June real weekly earnings 0.0% vs 0.0% exp m/m. Prior -0.1%

The euro took the inflation numbers and ran with the core, which dropped, to rise to 1.3494 but it’s since been slammed back down to 1.3459. USD/CHF did the opposite, dropping towards 0.90 before breaking a new high to 0.9027 and the 55 wma.

Gasoline accounted for nearly two thirds of the price rises.

- Energy CPI +1.6% m/m +3.2% y/y

- Fuel oil -1.7% m/m 4.0% y/y

- Gasoline +3.3% m/m

Overall there’s not much to get excited about. Inflation remains unchanged but the fact that it is still elevated is what has got dollar bulls priming themselves for possible Fed jawboning on rate hikes.

At the moment though there’s indecision in the prices as USD/JPY has fallen to 101.42 and EUR/USD is clawing it’s way back up to the 1.3480 level. We’re likely to see resistance here now.

US CPI & Core CPI y/y 22 07 2014