Larger speculative short positions, rising US yields and unstable risk sentiment are pointing to a limited downside in EUR/USD from here says Credit Agricole in a note.

PMI data next week might surprise to the upside and Fed rate expectations may wane further.

Not a good idea to start shorting says they.

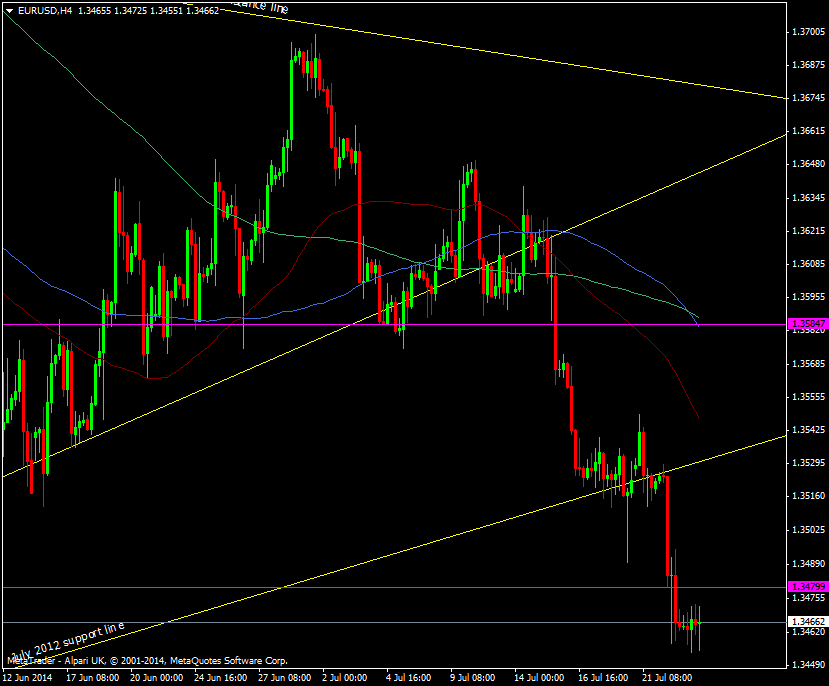

I’m inclined to agree but the break of the 2012 support line and 1.3480 level gives those who missed out a potential opportunity to get in on the short side.

EUR/USD H4 chart 23 07 2014

I don’t like chasing a trade or getting heavily involved unless broken levels hold. So far we haven’t had a real attempt at 1.3480 but the break of that July 2012 was the one to be on. If you do feel you’ve missed the boat then look at these levels to lean your trades against with the stronger place to look.