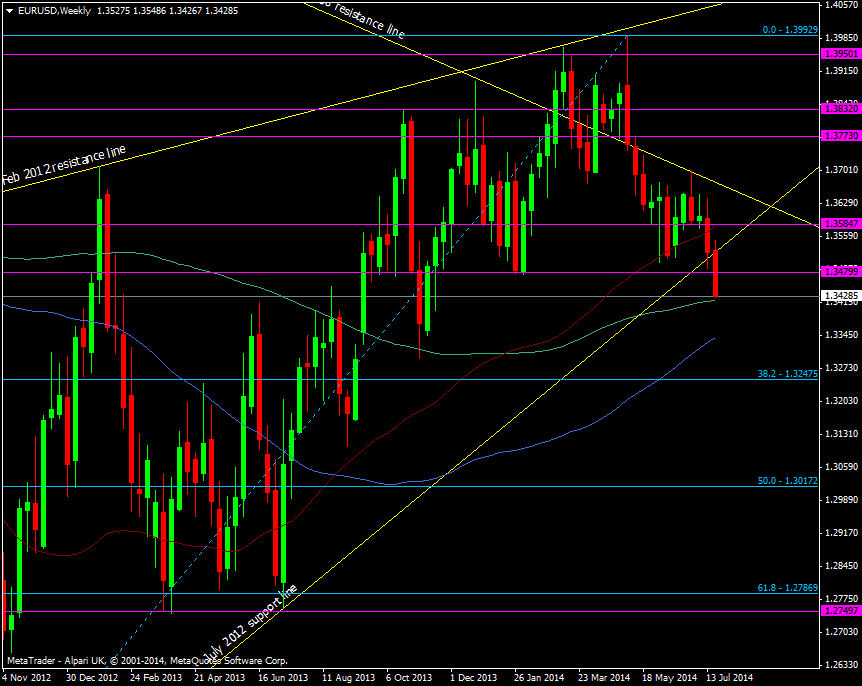

The 200 wma is close by at 1.3420 and the last time we held a close below was 9th August 2013. The break then held in the week after and again in early November. The close this week is going to be quite important as a close below the level could spell trouble for longs.

EUR/USD Weekly chart 25 07 2014

Under here are two more sizable tech levels in the 55 mma at 1.3383 and the 100 wma at 1.3340. This marks an area that that is going to have me reassessing my long strategy.

It’s a bit of deja vu as I was in the same position with my aussie longs that I bought from 0.9500 all the way down. I’m more worried about this trade though than that one when it was under water. I was expecting a bit more life from Europe than I’ve got. The economy is not going backwards, which is a minor plus, but it’s not improving which suggests that it’s going to be a much longer time frame than I was prepared for.

Psychology plays a big part in trading and it could be easy to sit here and look at the level of the euro and get freaked out. Sometimes you can’t see a trade turning around. That’s why a trade plan is so important as you can plan and be prepared for the points where you decide to hold or bail. I was prepared for any loss the day I pushed the button on it so I’m not sitting here with my head in my hands without a clue what to do.

If the trade loses ,the trade loses and I’m prepared for it and that is a key aspect of trading.