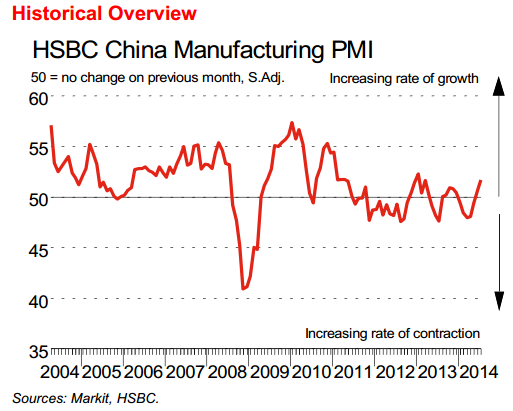

HSBC/Markit Manufacturing PMI for July,

- expected 52.0,

- prior was 50.7,

- flash reading was 52.0

- 18 month high for the July (final) result

- Output and new orders both increase at faster rates

- New export orders rise at second-quickest rate since November 2010

- Strongest expansion of purchasing activity for nine months

Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC:

- “The HSBC China Manufacturing PMI rose to 51.7 in the final reading for July, the highest since early 2013.

- This is slightly lower than the flash reading released earlier, as several sub-indices saw small downward revisions.

- Nevertheless, the economy is improving sequentially and registered across-the-board improvement compared to June.

- Policy makers are continuing with targeted easing in recent weeks and we expect the cumulative impact of these measures to filter through in the next few months and help consolidate the recovery.”

Earlier: China official Manufacturing Purchasing Managers Index (PMI) for July: 51.7 (vs. expected 51.4)

–

AUD/USD lower on this data too.

We had the official China PMI come in better than expected … the AUD popped a little into the wall of selling again. It declined then on the release of the Q2 PPI (came in lower than prior, suggesting the CPI has peaked and will head lower), then fell again with this HSBC data. Hard to see the AUD rallying too much … though on NFP night stranger things have happened. Have to say the odds appear to be with a lower AUD though. (Carry traders will disagree with me.)