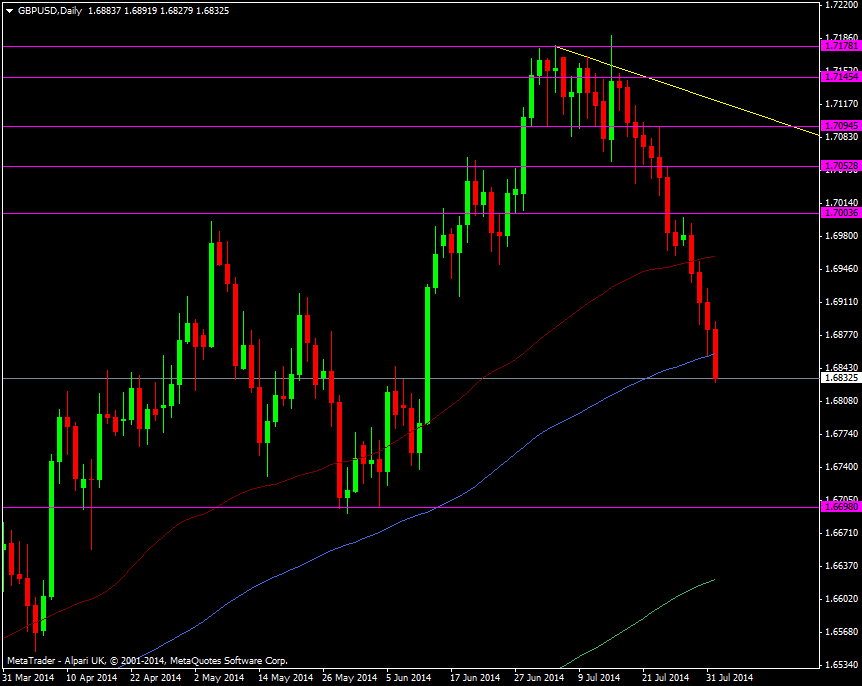

We pulled up at the 100 dma at 1.6857 yesterday and that’s gone now in the latest run down. There could be mild support seen at 1.6820 and 1.6800 but there’s nothing really of note until 1.6700

GBP/USD Daily chart 01 08 2014

A lot of the move has been driven from the dollar side but a big part has also been from a potential slowdown that the BOE warned about. while this hasn’t really pushed back rate rise expectations just now that might start to feature more prominently is the data sours to any further degree.

The question is whether it develops into something more than just a temporary slowdown. We at ForexLive have been saying that the UK economy needs to get its second wind with the help of exports but that side is still very weak. A domestic recovery will only get you so far and can only sustain you for so long before you need help from somewhere else.

If that help doesn’t come then we risk slipping back as confidence will fall and so will sentiment. That may lead to employment taking a hit if companies feel that we’re in danger of falling back into the bad times. If the sentiment that has helped the recovery turns then it could accelerate any downside.

Of course it’s far too early to start taking down the bunting and party balloons but it’s something we need to look out for and monitor. Some pull back is in order after the year+ long run the UK economy has put in. As long as that pull back doesn’t become a collapse then we’ll be fine. Cable could well be worth buying still but the mood the market is in now means we may see better levels yet.

I’m going to be looking at the 1.6700 level as a possible entry point but I’ll be judging any move to there on its merits at the time.