Time to look at some numbers for the hottest data point in town today. Actually it’s not but I’ll get to that later.

The top 5 NFP predictors this month are;

- Wesbury/Stein at First trust

- Nariman Behravesh at IHS Global Insight

- Christiane Von Berg at Bayerische Landesbank

- (name unknown)Intesa Sanpaolo

- Thomas Lam OSK-DMG

Here is there performance charts as well as their expectations for today.

NFP top 5 pickers 01 08 2014

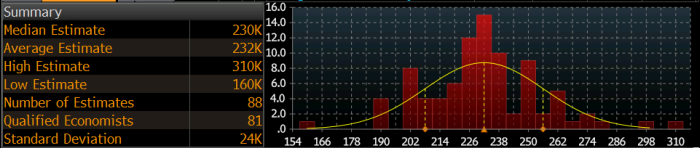

As usual Adam has broken down the numbers in detail and here is an update of the NFP figures. Yesterday the lowest call was 190k and since then there has been a 160k from Southern Polytechnic State

NFP by the numbers 01 08 2014

Much as I hate to say it I think this months release is going to be a damp squib. We know that jobs have been steady. From Jan 2013 to date the average has been 206.44k. Initial jobless claims have been confirming that picture also with the 4 week average falling over that period too.

US initial jobless claims 4 week average 31 07 2014

Many other indicators have been pointing to jobs growth too so we can probably take it to the bank that we’re not in for any shocks. That doesn’t mean we don’t get any. A big miss, say sub 200k will see a knee jerk lower in the dollar. Less than 180k and we might see real fireworks. The main risk to the data is the participation rate and any effects on the unemployment rate. If sentiment is improving on the ground then more people are going to be encouraged to get hunting for jobs and that will muddy the waters somewhat. We also need to watch for any further wage inflation pressures from the average hourly earnings as this will get the hawks buzzing.

Anything higher than around 240-250k is likely to be enough to take USD/JPY over 103 and has the potential to give it a sustained push.

What is more important than these numbers today is the Markit and ISM manufacturing PMI’s later on. The market knows jobs aren’t a problem but manufacturing still needs to confirm a sustained revival and good numbers today will go a long way to confirming that. If we get any meaningful knee jerk lower in the dollar on NFP then good numbers here is likely to reverse that just as quick. Weakness and we will see further losses.

So what’s the trade?

I like to look at what can gain the biggest rewards so my ideal scenario would be to see a crappy NFP which I would buy to run into the PMI’s. A nice 50-75 knee jerk pip drop in USD/JPY or rise in GBP/USD would do me fine and I would consider holding onto that for the longer term unless the PMI’s collapse markedly

If we go up on the NFP then my current dollar longs will be happy and it will be bad PMI’s that may give the dip buying opportunity. Good PMI’s will have me looking for dollar dips somewhere in the future to load up on as that will be further confirmation that the US is doing well and that the rate brigade will increase in volume.

Long dollar is the bias I’ve got today so I’ll be looking for any reason that comes about to load up. As always though it will be the data at the time that makes that decision.

Let us know what plans you’ve got for the data today.