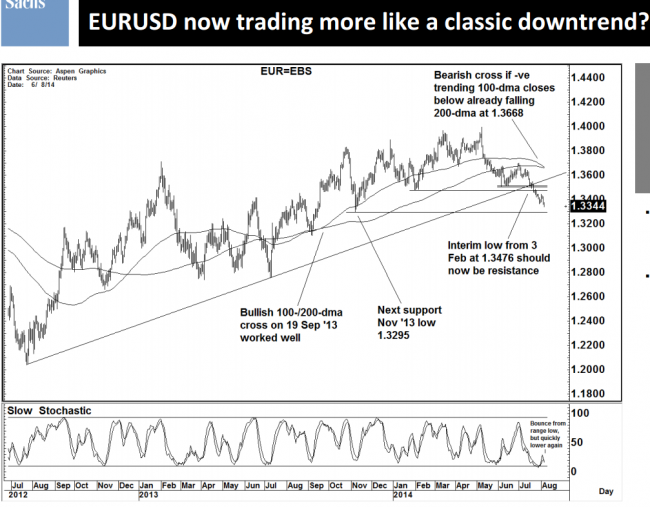

From Goldman Sachs’ weekly “The Charts That Matter”, a look at EUR/USD:

- As daily oscillators moved towards their recent range base last week concerns of material ST stabilisation/bounce increased. With hindsight the market however appears to be trading far more like a classic (bearish in this case) trend as oscillators quickly attempt to turn lower again and the market continues to a new trend base

- From here before putting too much focus on daily oscillators real +ve divergence (i.e. lower-lows on spot vs higher-crosses/-lows on the oscillator) likely needs to develop.

- In terms of levels; next support the interim low from Nov. ‘13 at 1.3295 and resistance the interim low from 3 rd Feb. this year at 1.3476

-

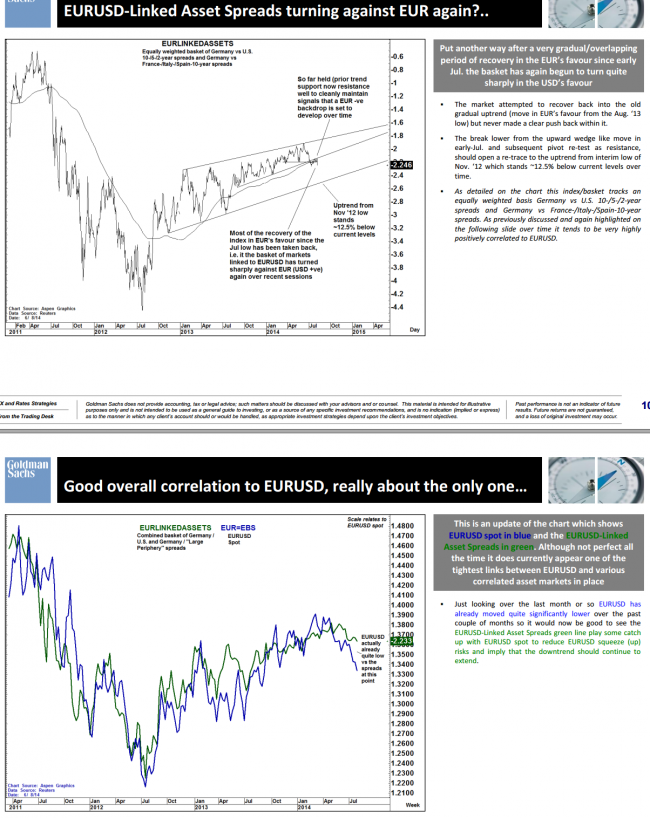

And some more: