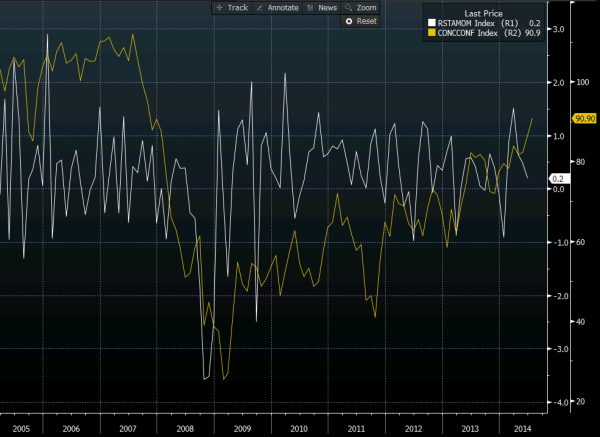

Consumer confidence was is at the highest since October 2007 at 90.9 last month, yet that confidence hasn’t been playing out into the retail numbers.

That may have come as a bit of a surprise to the Fed but we know it underlines a problem that we’ve seen all through the crisis and now out the other side. Consumers are still skint, in debt and wages are still lagging. People have been pushed to the edge and getting a job now doesn’t mean they will start splashing the cash on luxuries. Digging themselves out of the hole is the first task.

Even going back to 2007, when confidence was last this high, retail sales were still pretty weak. The signs of indebtedness and struggles were apparent back then.

US retail sales vs consumer confidence 13 08 2014

So, is this time different? I think we all know the answer to that.

Retail sales are expected to be unchanged across the board. 0.2% in the advance, 0.4% ex autos & 0.4% ex autos and gas. The only difference is the control group which is expected to fall to 0.4% from 0.6%.

Should we beat expectations by 0.2%+ the dollar will pop. The real trade will be if sales crumble and we get a dollar sell off. The rest of the data is coming out ok and the dollar is holding up because of it. If we drop then it’s likely to be faded pretty fast but see how big any miss is before jumping in. Anything that falls into the negative could see a decent sell off.

So get your coat on, get the shopping trolley out the cupboard and lets go shopping.