I know a lot of you like to play a gap close and given that the ones in most pound pairs is more of a crack in the pavement than the Grand Canyon, are we going to see it close up?

There’s a couple of key elements in these moves and they are probably both going to have to be overcome if we are to see it close.

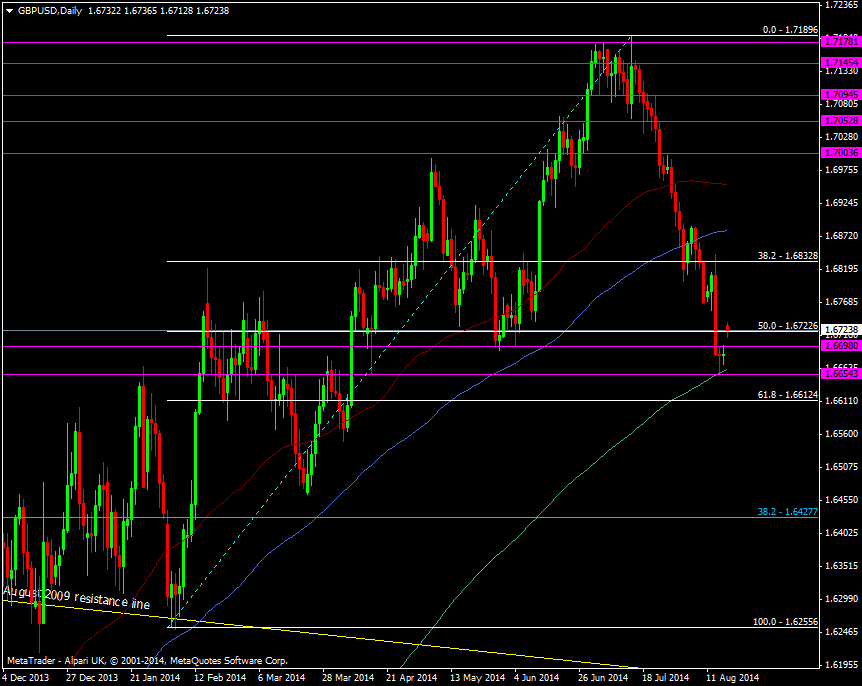

GBP/USD saw the 1.6700 level become resistance after we broke though last week. For two days it kept the price below and so it’s likely to now be acting as half decent support.

GBP/USD Daily chart 18 08 2014

1.6740 is the first line of resistance which was roughly the 11 June, pre Carney Mansion House pop low. The next level we should look for is the 1.6755/65 area ahead of 1.6800, 1.6820/25. The 38.2 fib of the 1.7190 fall is at 1.6860 and the 100 dma is 20 pips higher from there.

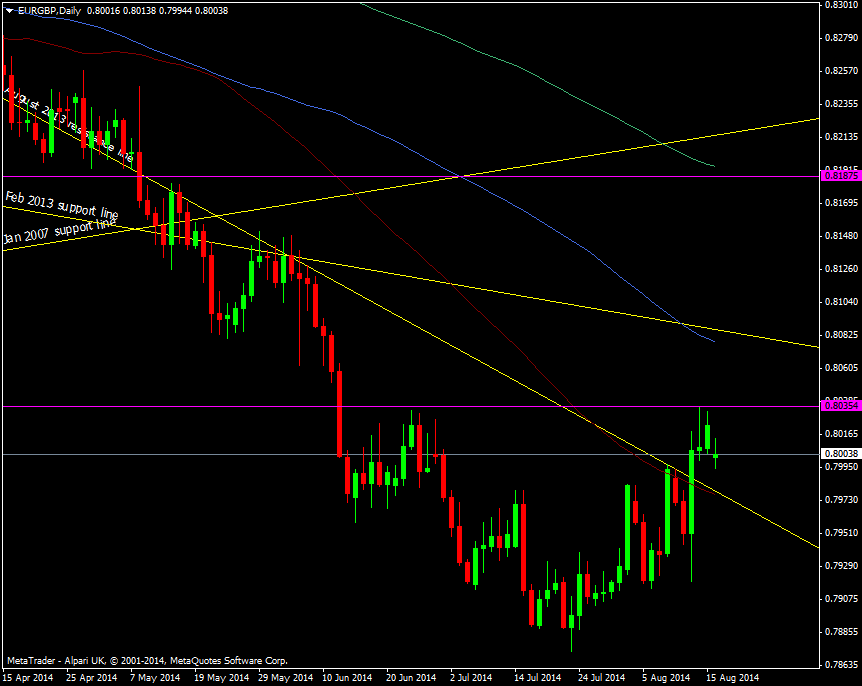

The second part of equation is EUR/GBP. It’s still holding onto the 0.80 mark and still has the support of the 55 dma and broken Aug 2013 resistance line.

EUR/GBP Daily chart 18 08 2014

While these levels hold it’s going to limit the pounds advance and keep the gap from closing. If the market does get itselfs overly excited ahead of the BOE minutes then we’ll see how strong these levels are.

It’s now down to you guys to say whether we “Mind the gap”

Will the pound close the gap?

Yes

No