The aussie is certainly putting up a stern fight as the pressure mounts against the AUD. The Chinese data had an impact as always, driving the kangaroo down through 0.9250 to 0.9238 and closer to strong support at 0.9200.

Adam noted yesterday that the aussie may not be hit so hard by overall USD bullishness as RBA’s Steven’s seemingly shut the door on rate cuts and intervention. I’m less inclined to think that the aussie will rise in the short term if this USD strength continues but there’s some key levels to watch that could halt any further move south.

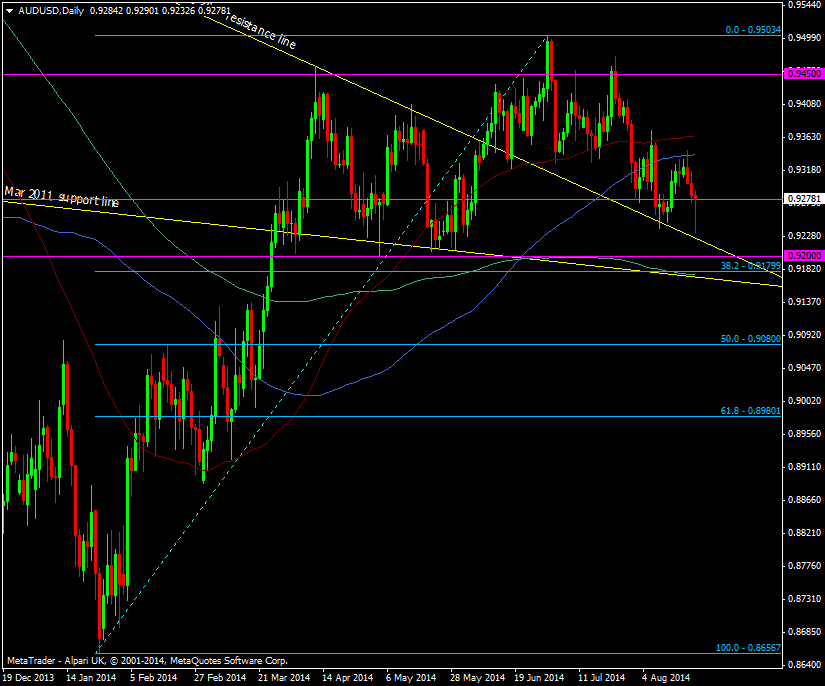

AUD/USD Daily chart 21 08 2014

Aside from the former Oct 2013 resistance line at 0.9225 and then the strong 0.9200 level, including the 55 wma at 0.9208, there’s a nice confluence of of the old Mar 2011 support line at 0.9170, 38.2 fib of the 0.8640 swing up at 0.9180 and the 200 dma at 0.9175. Tech wise that’s a very decent level of support and one that I’m looking at to add some longs at.

The decision I’m pondering though is whether to cut more of my long term longs in case this USD strength causes a further drop.

Either way I like these levels as a separate short term trade or to add to my overall position and it can be kept reasonably tight and with the potential to trade the break.