Before I go just a quick post relating to the UK govt’s public finances that I reported earlier.

The Treasury has now borrowed £37 bln – or £1.8 bln more this financial year compared with the equivalent period last year – meaning the Government is on course to miss its full year borrowing target of £95.5 bln.

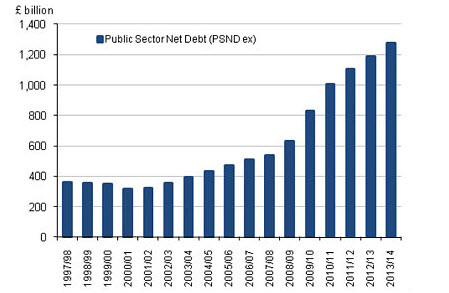

The figures also revealed that Britain’s debt grew to just under £1.3 trillion – or 76.5% of GDP in July, which represented an increase of £97.8 bln compared with July 2013.

UK Public Sector Net Debt

July, which is an important month for tax receipts because of quarterly corporation tax payments and income from self-employed workers, saw income tax receipts rise by 5.1% to £17.4bn compared with the same month last year.

However, receipts for the first four months of the financial year fell by 1.1% to £49.4bn, according to the ONS. Corporation tax payments also declined 4.8%to £6.6bn, and are down 4.3% at £14.7bn this financial year.

Now, I’m a trader not an economist but a GCSE A-Level economics certificate tells me this isn’t good (if my fading memory serves me well. lol) and a growing deficit can only continue to hamper the UK recovery.

Mr Osborne will have a lot of explaining to do and we can expect the opposition parties to focus heavily on this area as we head into next year’s election.