Having gone over it briefly the main jist I get is that she and the Fed are watching for reasons that will see the jobs market accelerate. While she goes through the cyclical vs structural reasons it makes a case for understating the level of slack and the possible effects if slack falls.

“Of these, greater worker discouragement is most directly the result of a weak labor market, so we could reasonably expect further increases in labor demand to pull a sizable share of discouraged workers back into the workforce. Indeed, the flattening out of the labor force participation rate since late last year could partly reflect discouraged workers rejoining the labor force in response to the significant improvements that we have seen in labor market conditions. If so, the cyclical shortfall in labor force participation may have diminished.”

“A second factor bearing on estimates of labor market slack is the elevated number of workers who are employed part time but desire full-time work (those classified as “part time for economic reasons”). At nearly 5 percent of the labor force, the number of such workers is notably larger, relative to the unemployment rate, than has been typical historically, providing another reason why the current level of the unemployment rate may understate the amount of remaining slack in the labor market.”

It brings a positive note that employment will continue to gain and perhaps at a much stronger pace going forward. This had got trdaers going gung-ho for the buck now and bonds are joining in. US 10’s yield 2.43% having been up to 2.44%

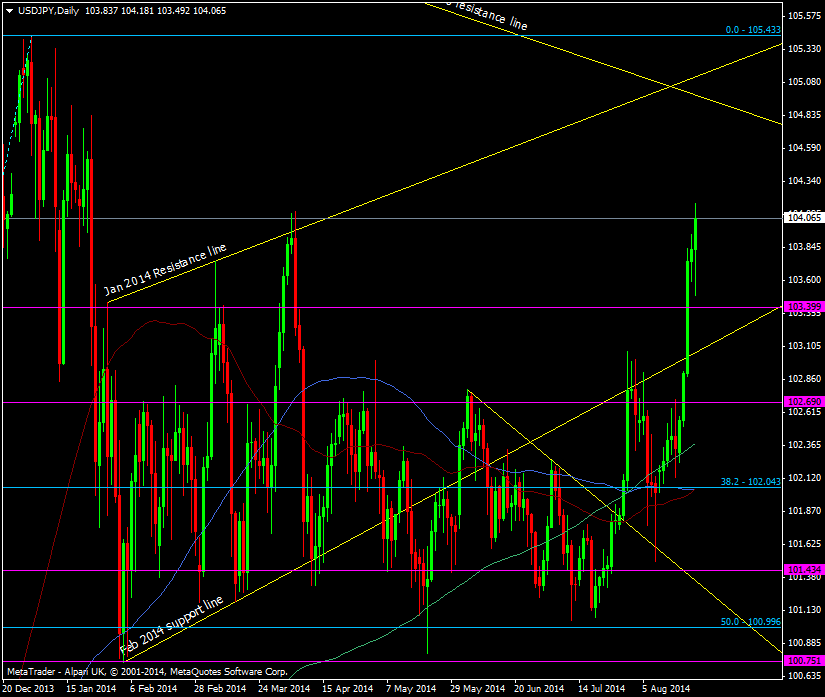

USD/JPY has busted through 104 to 104.19 and the eur has been crunched back to 1.3228

USD/JPY Daily chart 22 08 2014

We’ve broken above the April highs now and that virtually gives the green light to a bigger run up towards 105