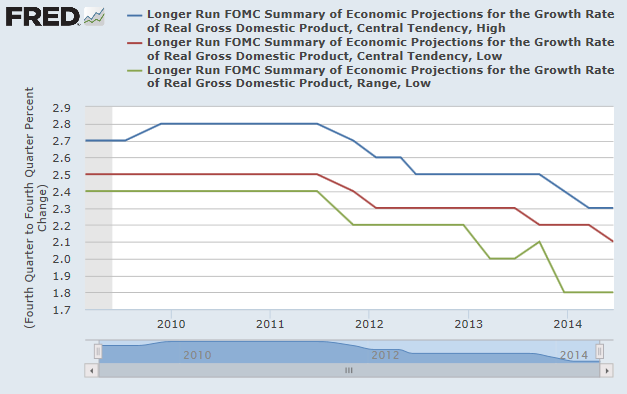

The Fed is slowly giving up on the long-term potential of the US economy.

In 2009, Fed officials began publishing economic estimates and since then it’s been a comedy of poor forecasting. Estimates have repeatedly proven to be overly optimistic and the Fed has continued to print money to compensate.

But even as forecasts missed for a quarter or two, the Fed always maintained faith that the US economy was more of a 2% economy than a 3% economy. Not any more.

The Fed is giving up on 3-percent growth

There is very little discussion about the move to the New Normal but with near-unlimited printing and rock bottom rates the US has averaged about 2% growth since 2011. Why do so many economists believe that 3-4% Fed rates are still possible?

In Japan, after nearly 20 years in this trap, politicians finally stopped asking the central bank to rescue the economy and started the path toward reform. The “lesson” of Japan’s lost decades was always supposedly that central bankers didn’t act aggressively enough but perhaps it should have been that politicians were the foot draggers.