Gold fell $22 to $1263 today in the largest one-day decline since July 14. Prices are now at the lowest level since June 17.

Dip buyers might be eying the dramatic fall with the hourly RSI down at 17 but the longer term picture points to more pain.

Technically, gold is showing signs of breaking down. Today’s fall breaks the uptrend since the start of the year and also could be a breakout from the flag formation.

Gold daily

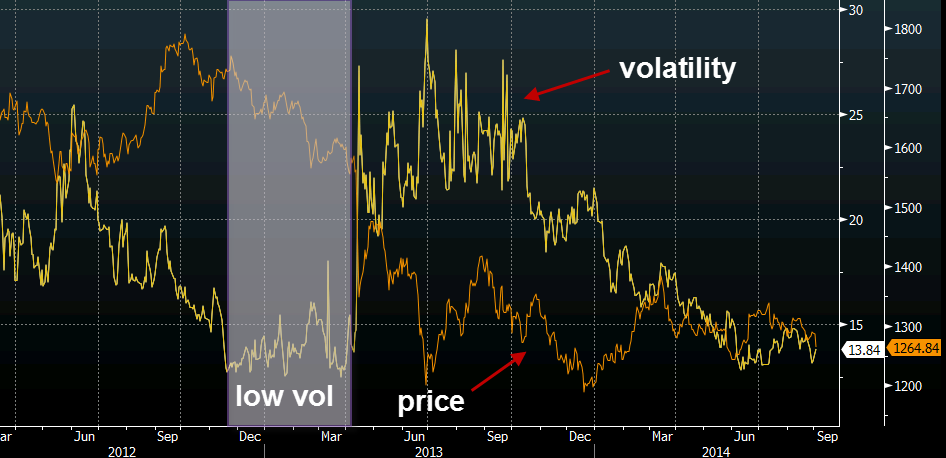

That’s hardly convincing but consider this: Gold volatility is at some of the lowest levels since March 2013 — right before the market cratered.

gold vs CBOE/COMEX gold vol index

Gold is a market that largely relies on hype (for lack of a better word). There are no fundamentals in the market so it needs to advertise itself and it can do hat via currency debasement (QE) and inflation. Right now neither of those things are helping, nor is the crisis-era enthusiasm for economic alternatives.

I believe the market has lost interest in gold to some extent and we could be near a tipping point where long-term holders opt to sell and move into other assets.

Gold fell $22 to $1263 today in the largest one-day decline since July 14. Prices are now at the lowest level since June 17.