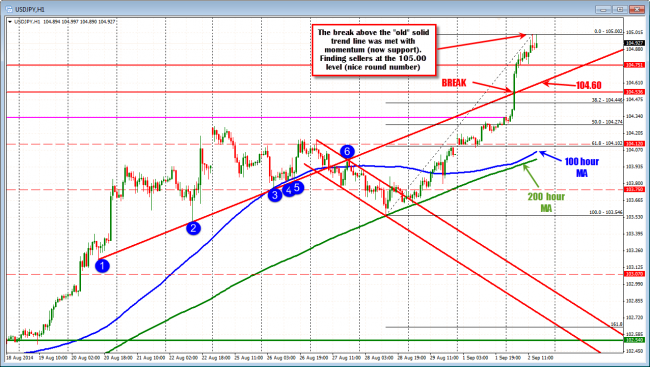

The USDJPY has trended higher today, breaking back above an old trend line in the process on the hourly chart (see chart above). The old trend line comes in at 104.60 (and moving higher). This is a risk level for traders who are riding the trend higher today and expect continued upside potential.

The move higher has been helped by a stronger stock market in Japan (remember that trade – buy the Nikkei and sell the JPY). Talk of a new pension fund manager who would direct more funds into the stock market was the catalyst for the excitement.

The high has extended to the 105.00 where the temptation of selling against such a level has attracted some profit taking. Nevertheless, trend days are fast, directional and can extend higher than most would think. So although there is some selling over the last 4 hours, the sellers are not really taking back control from the buyers.

Looking at the 5 minute chart below, the 104.86-88 level has a cluster of support from intraday highs/lows, the 100 bar MA (blue line in the chart below) and an upward trendline off intraday lows (after the spike higher in the Asian market). Staying above the line keeps the buyers fully in control. Move below and the market becomes a little more neutral (with a potential for a move toward the 104.75-79 area). Remember also, that the 104.60 level (and moving higher) is the strong line in the sand that should not be broken if this move was for real.

Longer term, the pair has the high for the year at the 105.43 area. Remember this high was reached on the 1st trading day of the New Year. It just would not be right to have the high for the year on the 1st trading day of the year would it?