I remember SNB day very well as I was fortunate enough to make some very decent money, but not as you may think.

The rumours of SNB intervention had been milling around for sometime and every little piece of Swiss data that was sour saw the swissy sold more than usual on expectations of SNB action.

I remember coming back to my desk from grabbing a bowl of cereal from downstairs and as I sat down I saw the first pop.

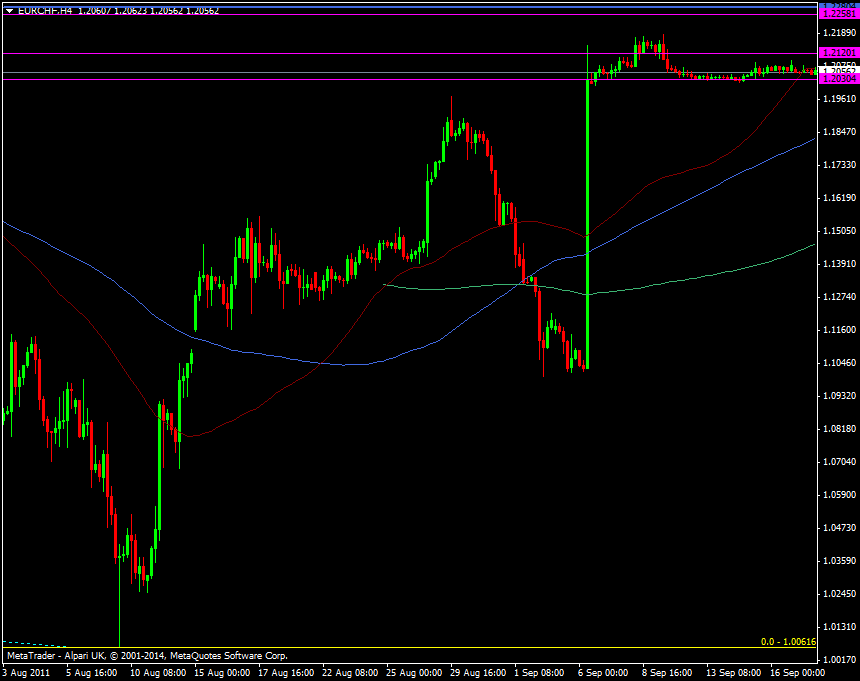

At times like that you’re not sure what you are seeing. As I said, the talk of intervention had been plentiful and we had already had a 1900 pip run up followed by a 900 pips fall in around 15 trading sessions in August alone, so the first moves had me thinking this was just another expectant trade.

EUR/CHF SNB intervention day

From the 1.1000 level I remember seeing it trade at 1.1200 first before trading 1.1500. At that point I started hammering the buy button realising this was something big. This is where I got very lucky.

One of the platforms that I used to use wasn’t very good and when something big hit (figures, tape bombs etc) it usually ground to a virtual halt, except in this instance where it continued to work but was running about 15 seconds behind the actual market price.

So there’s me seeing 1.17xx trading on my charting software and 1.15xx offered on my trading screen. What are you going to do?

Being the honest gentleman I am I phoned the broker to point out the discrepancy. Like f**k I did. I hammered it to buggery all the way up and even managed to short it at 1.21 after it had fallen back to 1.20.

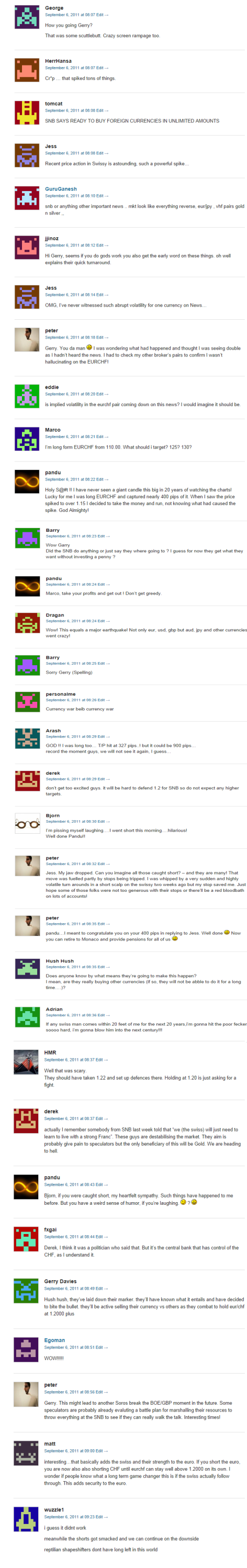

In the meantime I was still trying to find out what exactly had happened and it was good old ForexLive that came to the rescue. I wasn’t writing for the site back then, I was just a smart arsed commenter so my reliance on ForexLive was very great. The comments that day capture the astonishment that we all felt.

“They did WHAT?”

At the end of it all, when things had calmed down somewhat a day or so later, I took a sizeable long at 1.2010. There was some good opportunity to job it between 1.2020 and 1.2040/50 throughout September so I played that range but then cocked up. I wanted to maintain the big long from 1.2010 to hold long term. I had a holiday booked that month and just before I was due to go it spiked to 1.2090. I let out my long thinking, I’d got myself some decent spending money, 1.21 would hold, and I would be able to buy it back again around 1.2010/20. I’m still waiting. From there it was a swift run to 1.2300 and at the time I thought the trade had gone.

I guess that’s part of the reason I’m so hell bent on buying it all the way back down here as I’m regretful over messing up the original trade. Of course there’s been a lot of water under the bridge since and plenty of time to trade it as a normal pair, but I have always been willing it to go lower just so I can get in as close to the floor as possible.

But you know what they say, be careful what you wish for

Let us know how you got on that day. Is anyone still long from below 1.20, all that time ago?