I’m looking around the pound pairs to see what opportunities might pop up to make a quick buck over the Scottish vote this week. Yesterday I made a case for trading EUR/GBP shorts after the vote but here’s a scenario for trading just before and during the vote.

On Thursday morning we have the SNB monetary policy meeting and the market is looking at the SNB to make a move. I don’t think there are many traders who are thinking that we’ll get actual intervention so the likelihood is we get a policy move if anything. There’s also a risk we get nothing and that might sink Swiss pairs.

The first scenario I’m looking at is if we get nothing from the SNB and a “no” vote from Scotland as they will have opposite reactions.

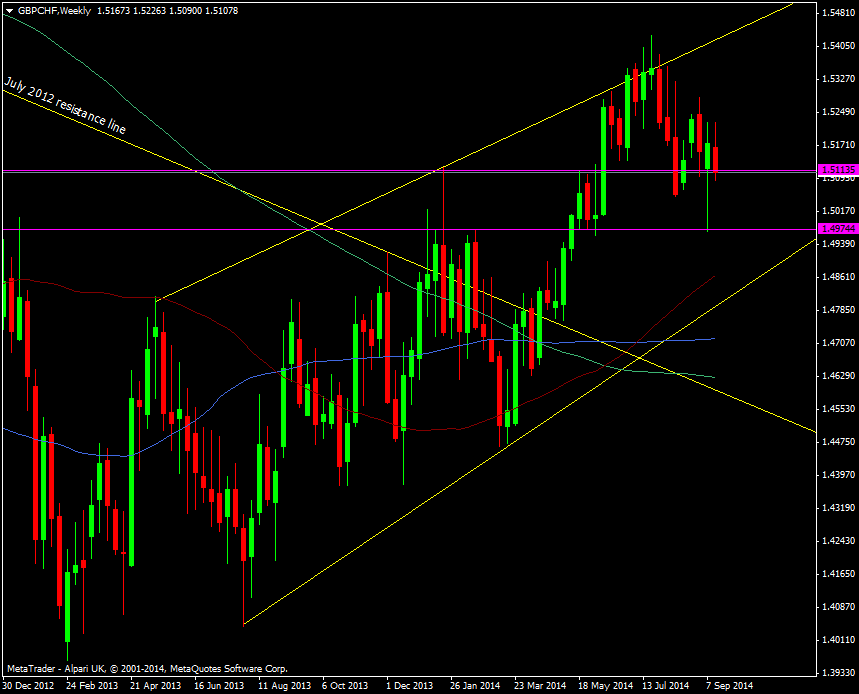

The 1.4975 level is a fairly strong level but is too close to the current price to contain a volatile move. Ideally a move down towards the 55 wma at 1.4866, the 55 mma at 1.4835 and the June 2013 support line at 1.4800 would be a better entry point.

GBP/CHF Weekly chart 16 09 2014

With further support under there at the 100 wma at 1.4719, then the 200 wma at 1.4627, there’s plenty of big, longer term tech to lean against. It all depends on the market reaction at the time so it will be a judgment call whether there is any true value in the trade. If we only see a 50 pip fall over the SNB then I’ll probably leave it well alone. If the SNB do act the the value is likely to be wiped from the trade I’m looking at.

This trade is one where all the pieces need to fall into place and so I’m going to be very particular with my parameters. If they don’t match up entirely then I’ll forget about it as indecision often leads to a bad trade. I’m looking for trades which will potentially have a big bang for my buck rather than looking to nick a few pips here and there.