Australia – Westpac / Melbourne Institute (MI) Leading Index for August comes in again at -0.1% m/m

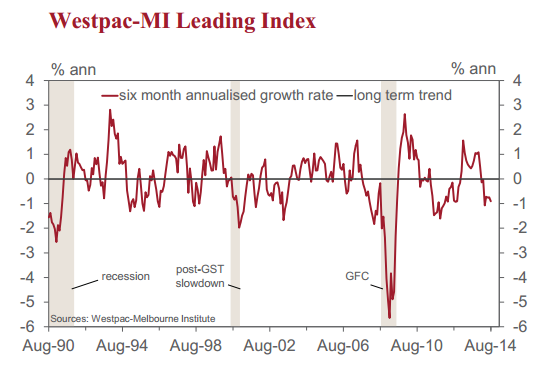

- The 6 month annualised deviation from trend growth is -0.9% (from -0.75% in July)

- seventh consecutive month where the growth rate in the Index has been below trend

Comments from Westpac (bolding is mine):

- The index continues to indicate that we can expect growth in the Australian economy to stay below trend in the second half of 2014 and into 2015

- Westpac is more optimistic around the growth outlook than the Reserve Bank … we expect below trend growth in the second half of 2014 but at a 3% annualised pace rather than the 2% implied by the Reserve Bank

- Commodity prices have intensified their drag on the growth rate; the slowdown in dwelling approvals has led to a reversal in the effect which that series is having on the index; consumers are less nervous around the labour market; and the flattening of the yield curve has become a drag on growth

- The changed contribution from the yield spread has resulted from a flattening of the yield curve. A fall in long rates which is not matched by lower short rates indicates that the stance of monetary policy may have tightened. Of course the yield curve, in particular the long end of the curve, is capturing both domestic and international influences. Since August the yield curve has steepened by around 30bps pointing to an easing in the assessed policy stance

- We do not expect to see the Reserve Bank changing rates anytime over the next year. Indeed, the Bank once again confirmed its intentions in its September board minutes for a period of stability in rates. Westpac expects that, with our expectation of a more favourable economic environment than is anticipated by the Reserve Bank, the next move in rates will be a tightening but not until the second half of 2015, with August currently appearing to be the date for the first move.