The main reaction following the FOMC meeting tomorrow will depend on the words “significant” and “considerable”.

Those are the two key words that relate to the jobs market and guidance on how long rates will stay low.

Will Yellen finally fire the starting pistol for rate hikes?

The July 31 FOMC statement said:

“A range of labor market indicators suggests that there remains significant underutilization of labor resources.”

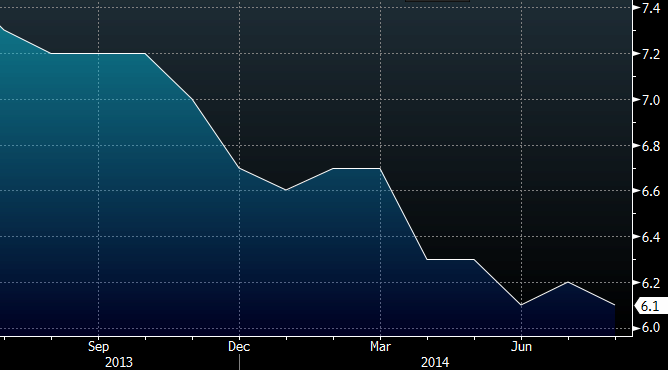

An easy way for the Fed to take a slightly more hawkish stance would be to remove the word ‘significant’ as an ode to improvements in some labor market metrics. There was a higher likelihood of such a move until the soft data in the most-recent non-farm payrolls report. The unemployment rate is also the same as it was in June.

Unemployment rate the same as June

What’s priced in:

I’d estimate there’s a 20% chance of a change that’s priced into the market.

The second key area to watch is the guidance about when rates will start to go up:

The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends.

Changing this statement in any way would be construed as hawkish and the likelihood of a hike by June/July would rise significantly. One thing to watch would be simply removing the part “after the asset purchase program ends” as Goldman Sachs warns. That’s because the ‘considerable period’ (probably six months) would start now and point to the potential for a March hike. Either way, the US dollar would rally.

What’s priced in:

There’s been a lot of talk about a change in this line. Hilsenrath threw a bit of cold water on it today and that weighed on the US dollar. A CNBC poll shows 43% of people thinking the phrase will be removed but I’d say the market is looking at a roughly 25% chance that it’s removed/altered.

Bottom line

Buy the rumor, sell the fact. Fed statements are always over-hyped and the Yellen/Bernanke Fed moves at a glacial pace. The bulk of the Fed will once again look around the room and say “what’s the rush?” despite clear signs of economic improvement.