Trouble in New Zealand is often a precursor to broader worries

The New Zealand dollar is nicknamed the kiwi, which is a reference to a type of bird, not a fruit. But the nickname could easily be canary because of the hyper-sensitivity of the New Zealand economy and its delicate disposition.

With the kiwi hitting a one-year low today, keep in mind the potential broader implications of the decline.

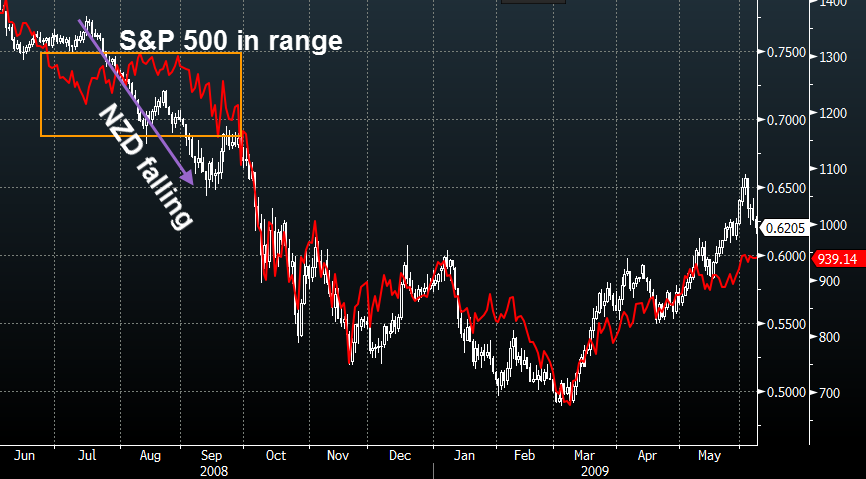

In the run-up to the financial crisis in 2008, the kiwi fell 12 cents while the S&P 500 continued to move sideways until two weeks after Lehman’s bankruptcy on Sept 15.

NZD vs S&P 500

In that case, the New Zealand dollar fell 12 cents over two months before the S&P 500 cracked.

This time the kiwi has only fallen 8 cents in two months but it’s something worth keeping a close eye on.

Since the crisis, NZD/USD has fallen 7+ cents in a short period on four occasions and the average high-to-low fall in the S&P 500 during those periods was 7.1%.

Now you can argue that we’ve already had a 3.6% correction in the S&P 500 but because the worries stem from China (NZ is more sensitive) and because the Fed could signal hikes any time and hurt the stock market, I would urge caution.

NZD vs S&P 500