Barclays September ‘Global Outlook’ is out today:

- The economic recovery remains weak, monetary policy support is extraordinary, risk assets are well supported and inflation and “safe” bond yields are at historically low levels

- ECB President Draghi appears to have declared another “We will do whatever it takes” policy stance, this time to prevent deflation (whereas last time it was to avoid a collapse in the euro area debt markets)

- This is likely to have important market implications … it should reinforce the trend toward weakness in the euro, especially against the dollar

- We believe the ECB will need to resort to outright government bond purchases to achieve its balance sheet objectives (a whopping 50% expansion) and to arrest the recent drop in long-term inflation expectations (an ECB bellwether for future inflation). This is not priced in and would send a powerful signal to market participants of the ECB’s determination to resuscitate growth and inflation.

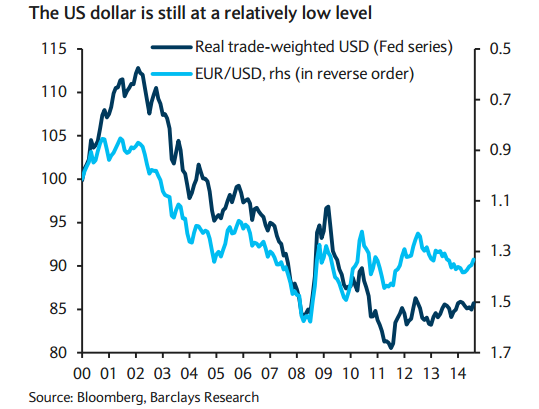

- There are reasons to believe in a generally stronger dollar as well: US growth appears set to accelerate and the Fed is winding down its large QE program and setting the stage for rate hikes.

- While the dollar has already moved up, it is still at a relatively low level from an historical perspective

- The Bank of Japan remains committed to extraordinary monetary stimulus

Key recommendations:

- Sell EUR/USD

- With more dollar strength expected, we recommend shorting gold

- In oil, better pipeline connectivity to the US gulf means we recommend selling the WTI spread on any big move below $8/barrel