National CPI y/y for August, 3.3%

- expected 3.3%, prior was 3.4%

National CPI y/y excluding Fresh Food for August, +3.1%

- expected 3.2%, prior was 3.3%

National CPI excluding Food, Energy y/y for August, +2.3%

- expected 2.3%, prior was 2.3%

Tokyo CPI y/y for September, +2.9%

- expected 2.7%, prior was 2.8%

Tokyo CPI excluding Fresh Food y/y for September, +2.6%

- expected 2.6%, prior was 2.7%

Tokyo CPI excluding Food, Energy y/y for September, +2.0%

- expected 2.1%, prior was 2.1%

–

I noted this earlier (and last month, and the month before that, and ….). Here it is again:

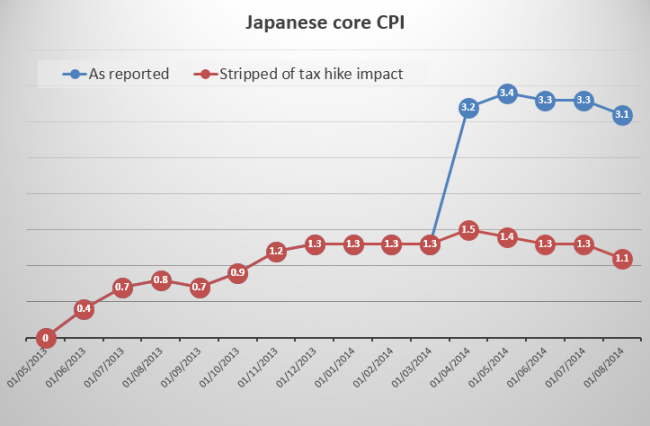

The Bank of Japan has estimated that the sales tax hike – to 8 percent from 5 percent on April 1 – added 1.7 percentage points to the annual consumer inflation rate in April, and 2.0 points from the following month.

–

National CPI y/y excluding Fresh Food for August, +3.1% …. slightly below expectations

BUT … Tokyo headline CPI in above expectations and Tokyo ‘core’ CPI (excluding Fresh Food) in at expectations …. ‘core-core’ CPI (excluding Food, Energy) is slightly below expectations

So, a bit of a mixture of results there for Japanese CPI. USD/JPY was dribbling lower ahead of the release and its stabilised around session lows as I update this post.

On balance, slightly disappointing results for the BOJ.

Useful chart from the Financial Times (FastFT – subscription required):