More from Morgan Stanley’s weekly ‘FX pulse’ (discussion of US dollar, EUR/AUD here)

- This week, we add a long GBPNZD position to our portfolio

- Uncertainties about the outcome of the Scottish referendum have passed, allowing the focus to return to rate differentials.

- We expect the BoE to hike rates in spring 2015, probably before the May General Election

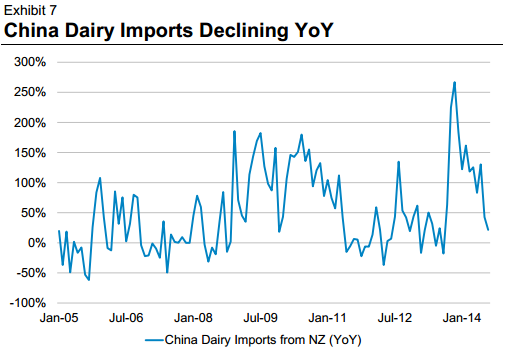

- On the other hand, the RBNZ has to incorporate falling terms of trade into its macro projections. The leveraged farming sector, where revenues have been hit hard by falling milk prices, have cut investment. Solvency could become an issue if milk prices do not recover quickly, which is unlikely given the oversupplied milk market.

-

- Tactically, we sell SEKJPY. The risk of the Riksbank needing to cut rates will increase. The Swedish economy is weak and Russian trade increasingly impaired. In addition, trade with Eastern European partners has slowed down, the result of political uncertainty and declining credit growth.

- On the JPY side, we see the Abe government becoming increasingly concerned about JPY weakness reducing real disposable income via rising import prices

–

- A number of USD/EM crosses look stretched to the topside, which suggests that caution is required before adding to long USD positions versus all EMs.

-

- We stick to our long USD/SGD position, which we expect to perform well as regional growth concerns start to weigh on the currency following the sharp deterioration in China data. Singapore remains heavily dependent on exports and is one of the main examples of regional economies that have relied heavily on an increase in leverage to support growth in recent years. Singapore’s monetary policy regime is heavily linked to the US too, and further rises in US funding costs will naturally tighten conditions in Singapore too. Meanwhile, the demographic outlook remains challenging too.