Highlights of the US August durable goods report:

- Prior non-defense ex-air was -0.5% (revised to -0.2%)

- BBG had the consensus at +0.4%, RTRS at +0.5%

- Overall durable goods orders -18.2% vs -18.0% exp

- Prior revised to +22.5% from +22.6%

- Ex-transport +0.7% vs +0.7% exp

Shipments:

- Aug core +0.1% vs +0.5% exp

- July revised to +1.9% from +1.5%

The huge decline in overall orders is no surprise. A month earlier, Boeing announced a record month for aircraft orders and that skewed the report much higher and to a single-month record. The decline this time is simply a reversion to the norm.

The good news is that core orders were a bit stronger and July’s data was revised a bit higher, that’s a good signal on the underlying strength of the economy.

The shipments numbers are important for GDP but the revisions to July balance the miss in August and overall it should have no net effect on Q3 GDP.

Bottom line: More signs of a slowly strengthening US economy and that will keep the US dollar rally going.

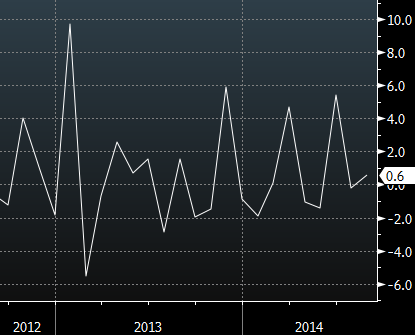

Capital goods orders nondefense ex-air