The final numbers for US Q2 GDP is the main highlight on the calendar today and the market is looking for good news in the revisions.

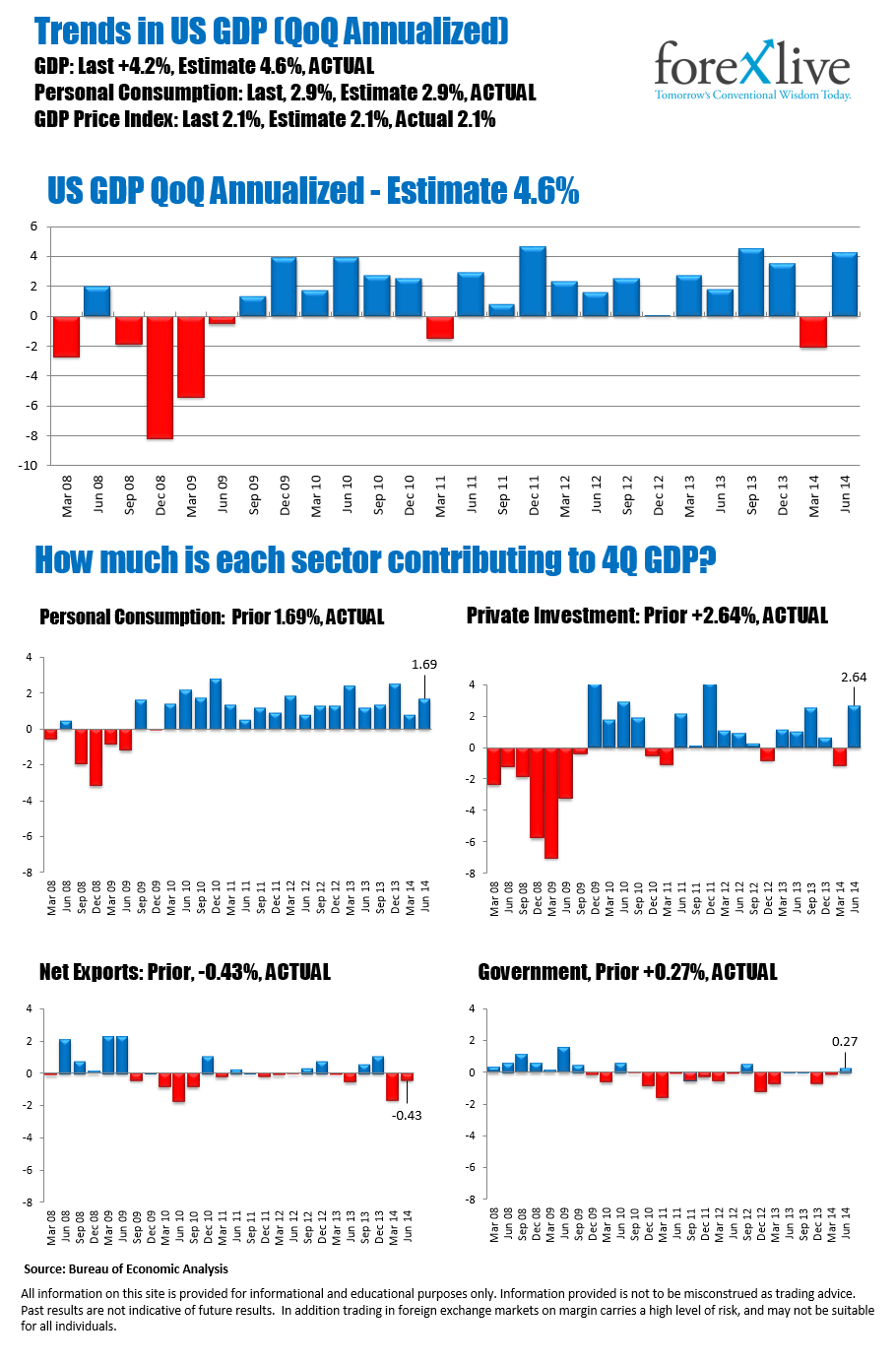

- The second reading of annualised GDP rose from 3.9% to 4.2% and we’re looking for a bigger gain to 4.6% q/q

- Core PCE is expected in unchanged at 2.0% q/q, PCE prices unch at 2.3%

- GDP deflator expected at 2.1% vs 2.2% prior

Unless we see a massive jump in the PCE revisions we’re unlikely to see any market action from there. What will swing the market is if we see personal consumption and/or business investment missing expectations.

The last revision saw consumption rise slightly to 2.5% from 2.4% and the market is looking for a sizeable jump to 2.9%. Business investment rose to 8.4% from 5.5% in the last revision.

I think the market might be a little over zealous on the headline number, and particularly the consumption numbers and so we could see a decent dip in the dollar if they come in under expectations. Exports are still nothing to write home about but saying that, there’s nothing really to suggest that overall growth is showing any signs of slowing. The consumption number will be the one to keep an eye on. Growth is fine but will only go so far if spending doesn’t strengthen.

To summarise, personal consumption and business investment could be the big swingers for market moves. Any deviation of of 0.3% either way for consumption and we could have a half decent move.

If we get good numbers then the buck will ramp up again on the Fed raising rates and expectations for a good Q3. Bad numbers will dent the dollar but again it’s likely to be limited with swift buying on rate expectations. We’ll need to see a complete collapse of GDP to take the bullishness out of this market.

US GDP- The current story