QUESTION from @Liem

“hi

anyone has a good idea whether we have seen temporary bottom for eur/usd.

if so,any chance of a retrace to 1.27/1.2750.

thanks.”

As Adam replied, all eyes will be on the ECB and Draghi on Thursday. I would 100% concur. The Thursday meeting is once again really important. Since the last meeting when new stimulus was initiated, the TLTRO program was launched and disappointed, The Core CPI Flash for the current month fell (although thank goodness for a 0.1% error otherwise the picture would be worse) and the headline came in at 0.3%. Things are not that great. We have gotten a little boost off the lows today on the back of the error in the core CPI and perhaps some weaker Consumer Confidence, Chicago PMI and Case Schiller out of the US. I am not sure Draghi and company can be successful in putting whipped cream on the ‘you know what’, but you never know. Plus, it is hard to figure out what has been priced in. So indeed all eyes will be on what is done and what is said and only he and the ECB members know exactly what will be done and said.

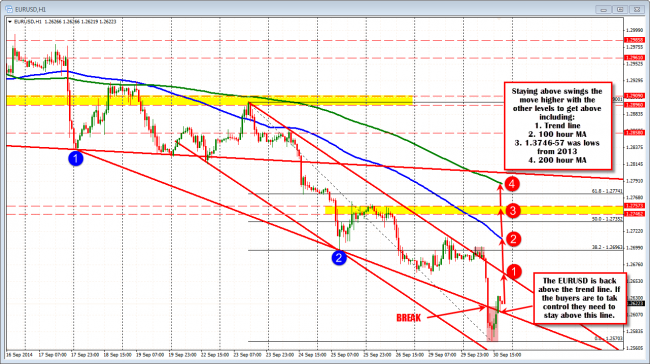

From a technical perspective, I wrote earlier as NY traders entered for the day that the pair had broken below trend line support in London morning session (see POST HERE) and that

A move above this level would put intraday traders on alert for a possibility of a further correction … [but] would expect that the 1.2660 level off the weekly chart should hold any correction

The price of the EURUSD has indeed moved above this trend line (see chart below). Staying above (it is now at 1.2615) will keep the buyers in control at least from this perspective. For me, a move back below the line would not be welcomed just because the trend is still down and that trend has been strong (not to mention the ECB will have a tough time on Thursday- I feel). So for me, that is my risk area (it may extend below 1.2600 for some who love the EURUSD, but again, I am not all that interested in fighting a trend).

If the price does hold then there is a chance for a move higher but the sledding is still tough but it is not out of the question to get to your level.

The below chart outlines the levels to get back above. The 1st is the parallel channel trend line. We “sideways our way” above this line in the Asian session today but not for long. The line remains a level to breach if we are to go higher.

The 2nd target is the 100 hour MA (blue line) at 1.2711 (and moving lower). We moved above this MA for 6 hours last week (see blue line) but that was rejected and the trend down continued. The good news is if you are looking for a move to 1.27-1.2750, a test of this would get you to the lower target. The upper target will take more buying (which should be difficult), but you have a good topside target in place if that buying does squeeze some shorts before the ECB, as this represents the lows from 2013. That area be real tough to get above on the first test (barring some huge fundamental surprise we don’t know about now).

When you buy against a low in a trending market, you are buying against a low and hoping. Plenty of traders before you tried the same thing, with most failing. So you have to be careful and respect the trend. Good fortune with your trading Liem.

Technical Analysis: EURUSD steps higher if support holds.