- Services revenues 26.9 vs 21.0 prior

- Employment 11.9 vs 13.2 prior

- Wages and benefits 19.9 vs 20.1 prior

- Hours worked 6.9 vs 4.1 prior

- Input prices 27.8 vs 25.0 prior

- Selling prices 8.0 vs 10.5

- Capex 14.5 vs 18.3 prior

Not a market mover but it’s another look at a slither of the US economy. Employment and wages down and a little squeeze on margins with a rise in input costs as selling prices fall.

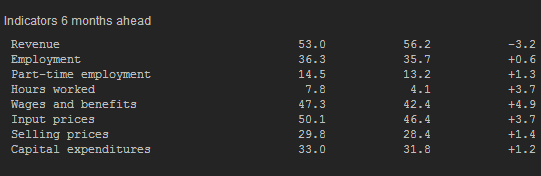

Expectations look slightly better but as we know, expectation and reality are sometimes worlds apart.

US Dallas Fed service sector expectations 30 09 2014