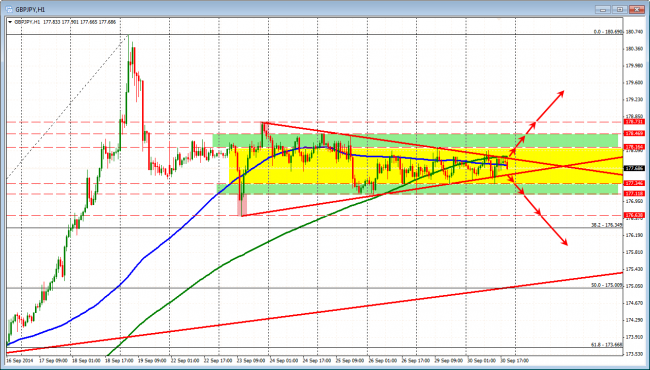

Yesterday, we were looking at this picture from this post: “Technical Analysis: GBPJPY coiling like a snake“:

Technical Analysis: GBPJPY coiling like a snake

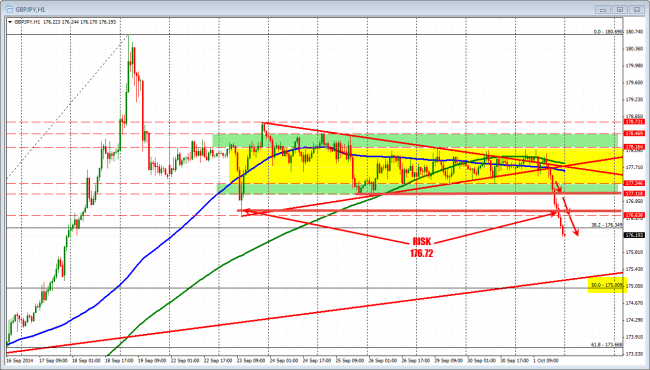

This morning when I revisited the pair, we were looking at this picture from this post:” Technical Commentary: GBPJPY short…”

Looking for a break below the 177.34 and then 177.118 to confirm sellers. RISK 100 hour MA (blue line)

The price trended away. Non -trending leads to trending.

I got lucky, righ?. Damn right I did and I am proud to admit that.

However, the luck I had was “Traders Luck”, and that is different than “Blind Luck”

“Trades Luck” is when you define and limit risk and “hope the market agrees with you.

“Blind luck” is when you trade without defining risk or limiting your risk and “hope the market agrees with you”.

With “Traders Luck” and “Blind Luck” the reward potential is the same. With “Blind Luck” risk is unlimited. With “Traders Luck” risk is both defined and limited.

Both types of traders have zero impact in moving the market. What do I mean?

Let’s face it, 99.5% of the people that read this post – myself included (I can write and read it) – cannot move the market one pip. I am not any where big enough in a 4 Trillion market to move the market a single pip. So I did not trend the market from 177.44 to 176.20. “The Market” did the heavy work for me. Thank you Big Boyz!!!

GBPJPY has trended lower today.

The only thing I could do was when the trade was put on, I could define my risk against the 100 hour MA. I could make the judgment that the longs had their shot to go higher and could not (3 times today). I could make the judgment, that if the price was to break outside the yellow and then green and then the low, that it was likely to trend because “non- trending leads to trending”. I even could make the judgment about “Three’s a Crowd” which is my hokey method of defining non trending markets and what to “anticipate (you can read my book: www.attackingcurrencytrends.com ) . All these things are in the posts from yesterday and today.

Anyway, do I take credit for making a good call? Not really. If it went against me, I would be a bum in the eyes of some who expect perfection (and I will be wrong. I can assure you that). However, I do take credit for defining risk and limiting risk (and knowing that that amount was the most I would lose). Apart from that, I am thankful, the “market” agreed with me and transitioned the price action from Non trending to trending. After all, two’s company, threes a crowd.

Not that it matters but1/3 profit was taken at 38.2%, and Risk can be defined a few pips above the low from September 23rd at 176.72. The 50% is the next target at 175.00.

.

Snake = GBPJPY