Overnight we saw the 110 level taken out and the chatter from Amari over “excessive” forex moves looks to have put a dampner on any follow through. The fact that level has been cracked could be significant though as it removes any psychological effects to the level.

As I type we’re moving back into 109.90 and a second look at the number will determine whether offers have tried to shore up the level once again. If we breeze on through then we’re likely to see the buck push on.

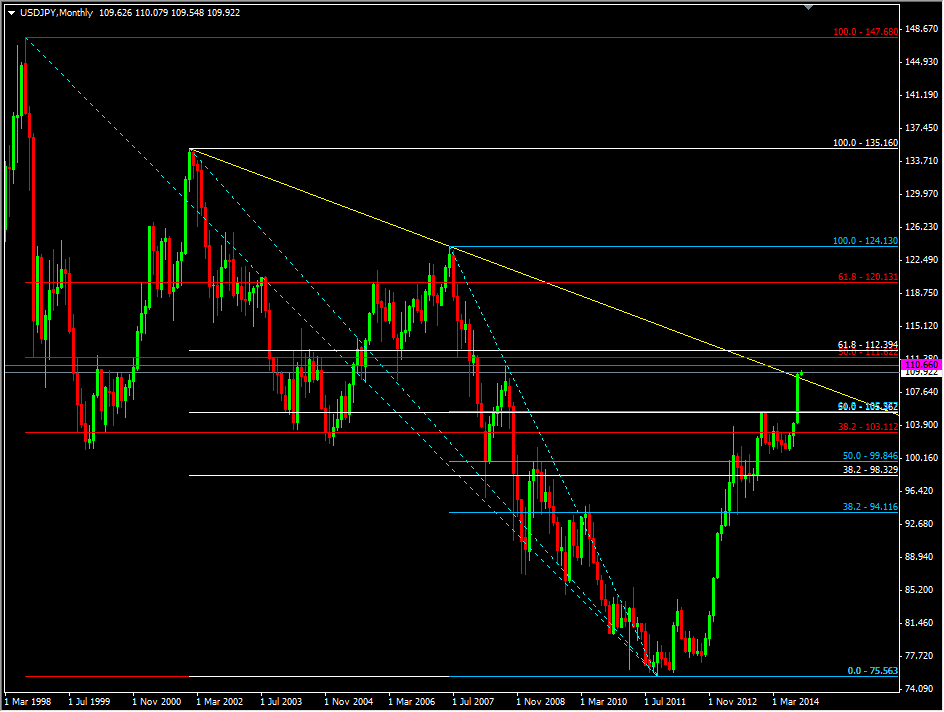

We have the next big resistance level at 110.66, being the August 2008 high and then we have a couple of big long term fibs to deal with.

USD/JPY weekly chart 01 10 2014

These two fibs from 1998 and 2002 at 11.62 and 112.39 could be enough to halt this rally, if we test them out. The big fins all the way up have yielded around 400 pips in moves the other way and they don’t come around too often. There’s still a way to go but with a couple of Fed members already making passing comments on the dollar’s level it’s likely that the chatter is going to increase. With Japan talking heads also perhaps looking for some stabilisation in the currency it would maybe suit both sides to see it tread water somewhere around the 100-110 mark.

Possible jawboning aside, and with jobs data coming up later in the week, we’re well within striking distance of these levels, and that’s the place I’m going to look to exit my longs and park some short orders.